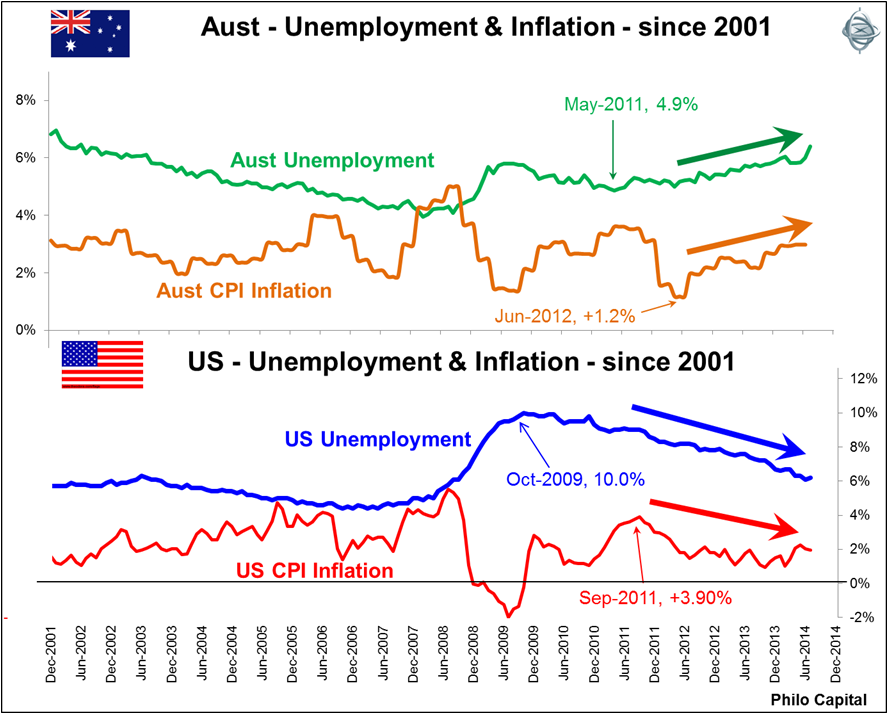

In the US, the two big policy imperatives – unemployment and inflation – have been going in the right direction (down) since 2011. Ultra-loose fiscal policy (four years of trillion dollar budget deficits) and ultra-loose monetary policy (near- zero interest rates and unprecedented money printing) have borne fruit, albeit slowly:- the economy is growing, the unemployment rate is falling, the budget deficit is contracting, deflation has been avoided, inflation has been low, and asset prices are rising (including shares, bonds, housing and commercial property). The ‘QE’ money printing program is coming to an end without rattling asset markets or investor confidence.

Falling unemployment plus very low inflation, despite the strong dollar and tightening budget, mean the Fed can start tightening monetary policy by raising interest rates. The big risk is that the Fed continues to dismiss rising inflation as ‘noise’, and keeps interest rates too low for too long. The likely outcome is that the Fed will wait too long and have to hit hard with unexpected interest rate hikes, rattling investment markets, as in 1994.

Standing behind Fed Chair Janet Yellen now is the new Fed Vice Chairman Stan Fischer who, as head of Israel’s central bank from 2005 to 2013, used aggressive money printing to over-stimulate the Israeli economy, resulting in high inflation and a roaring housing bubble.

Investors want to see the Fed keep interest rates low for longer, but not for so long that it will be forced to act suddenly and unexpectedly to tackle inflation. All eyes and ears are on Yellen and how she views inflation and unemployment. In July she indicated that the rising inflation was merely “noise”; that monetary policy (rate hikes) should not be used to address asset bubbles; and that her main focus is now on ‘under-employment’, which is running at twice the rate of unemployment. In her Jackson Hole address at the end of August she hinted at possible rate rises early in 2015, rather than mid-year. But she also made it clear that she would be very careful and responsive to any adverse effects of rate rises on growth or employment.

It is the reverse in Australia. Here we have rising unemployment rates and rising inflation. In addition we still have very loose, and now politically chaotic, fiscal policy (big budget deficits and a hostile, volatile Senate). Inflation is already at the top end of the RBA’s target range but the RBA cannot raise interest rates to kill inflation and cool the housing market for fear of causing the dollar and unemployment to rise even further.

August saw the unemployment rate rise to 6.4%, up from a pre-GFC boom-time low of 3.9% in February 2008 at the peak of the commodities boom. Inflation is now up to 3%, the top of the RBA’s target range, and up from just 1.2% two years ago. Even ‘core’ inflation is now 2.9%. July also marked the start of the new Senate, with Palmer and other micro parties making fiscal policy and genuine economic reforms more challenging. This is dampening business confidence and investment and may necessitate the RBA providing monetary support for longer – ie keep interest rates low for longer.

As a result, the RBA, like the Fed in the US, will also probably act too late and too harshly with rate hikes. Indeed the RBA may even try another rate cut first to try to bring down the dollar. This would probably further inflame prices in the property and share markets, as well as accelerate consumer price inflation. That would mean it would need to come down even harder and harsher with rate hikes later on.

Ashley Owen is Joint CEO of Philo Capital Advisers and a director and adviser to the Third Link Growth Fund.