A new report suggests that Australians, both young and old, are ill prepared for the largest wealth transfer in history.

It’s expected that about $100 trillion in assets world-wide will be transferred from Baby Boomers to their children over the next two decades. A 2021 Productivity Commission report estimated that around $3.5 trillion in assets will be transferred in Australia alone by 2050.

The inherited assets will mostly come in the form of superannuation and residential property. Inherited assets are predicted to rise from the current $120 billion per annum to $500 billion per annum over the next 25 years.

A recent report from stock trading firm, AUSIEX, found that the wealth transfer is likely to happen sooner than expected. It suggests Baby Boomers are leaving the workforce at an accelerated pace and they’ll be all but gone from workplaces by 2028:

“It doesn’t stop there. In 2027, the first of the baby boomers will reach their statistical age of death (81 years for men and 85 years for women).

Baby boomer superannuation balances will start to deflate out of the system through retirement consumption and then through disbursement via the inheritance process.”

Nest egg mentality

A new report from Fidelity International called ‘Rainbow’s End’ suggests most Australians want to share their wealth with the next generation but are unsure how to transfer that wealth. Fidelity surveyed 1,500 people over the age of 26, spanning Gen Y, Gen X, Baby Boomers, and the Silent Generation.

The report found about 50% of people are only somewhat confident or not confident at all in knowing how their wealth transfer goals will be met. Part of the issue is that most of those surveyed aren’t confident that their retirement savings will be enough to support their desired lifestyle. And most also admit they have a so-called nest egg mentality – that is, they want to avoid spending money, so they won’t run out of savings or not have enough to pass on to their family.

Passing on assets now or later?

However, around two in five people prefer that their wealth be shared while they’re alive. That’s almost double the number who’d like to leave their wealth as a bequest.

Interestingly, though, while most of the survey respondents want to transfer assets while they’re alive, they want to leave the majority of transferred assets for when they pass away. The report found that two in three people are likely to transfer 60% or more of their assets after they die.

As one survey respondent, a male baby boomer, remarked:

“I think not giving away too much, too soon. And also trying to keep my children motivated towards their own self-achievement goals and not falling into the thinking of they can always rely on me.”

As for what people want to achieve when transferring assets, the top two goals of those surveyed are to help their children with financial security and express their gratitude and love for them.

Source: Fidelity International

The challenges with transferring wealth

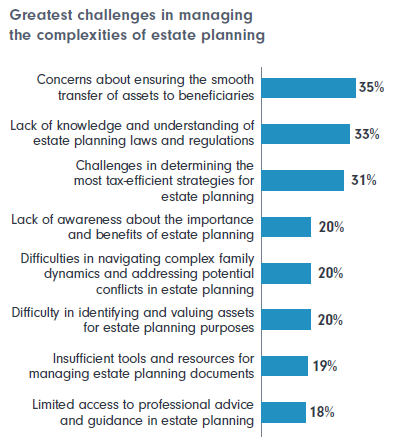

Those surveyed in the report highlighted several key challenges in leaving a bequest or transferring assets while they’re alive:

- Financial worries: having enough money to leave due to worries about the rising cost of living, insufficient savings, and the impact of taxes and fees.

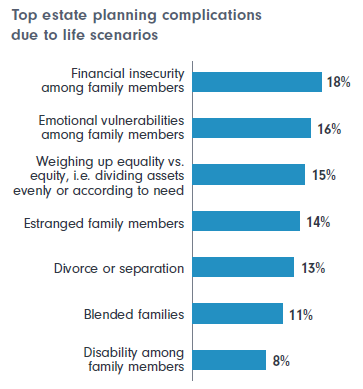

- Managing family issues: potential conflicts over the inheritance, disagreements over the distribution of the assets, differing expectations and interpretations of a will, and the possibility of rifts developing in the family.

- Legal and administrative issues: ensuring the validity of the will, finding a trustworthy executor or trustee, and understanding tax implications.

- Ensuring wishes are upheld: choosing the right person to receive the bequest, ensuring responsible use of the assets, and avoiding misuse or wastefulness.

- Uncertainty and lack of knowledge: uncertainty about how to proceed, unfamiliarity with legal requirements, and a lack of information or guidance.

Source: Fidelity International

One of the more fascinating aspects of the survey is what children are expected to do with the money from their parents. One in three think it will used to pay down existing debts. One in four believe it will be spent to maintain the children’s desired lifestyle, while 16% expect it to go towards education.

Financial and estate planning advice

The upcoming wealth transfer has financial advisors licking their lips, and this report will leave them even more optimistic.

The report found that while most people aspire to transfer their wealth, far fewer have made concrete plans to do it. Nearly two in three intending to leave a bequest have a will, yet less than 10% have a comprehensive estate plan.

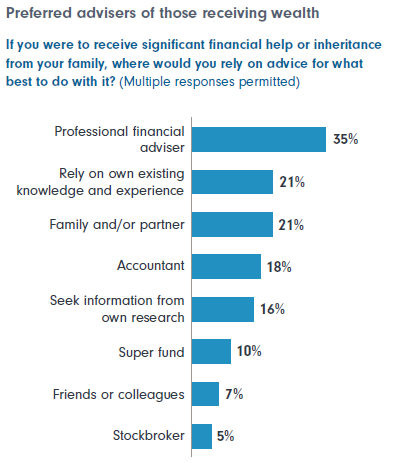

As for the popular source of advice for those receiving assets or an inheritance, a professional financial adviser tops the list, followed by self-reliance, and family.

Source: Fidelity International

The problem is that there may not be enough financial advisers to handle the increased demand for their services. There are now less than 16,000 advisers, down from almost 28,000 in 2018, before the Hayne Royal Commission.

Given the stringent education requirements to become an adviser, increasing those numbers won’t happen quickly. And superannuation funds being able to provide advice is unlikely to help much given most people require customised guidance for their personal circumstances.

A limited supply of advisers and growing demand can only mean one thing: prices will have to rise from current levels. With ongoing financial advice fees averaging close to $5,000 and out of reach for most people, it’s clear that industry change is needed. And fast.

James Gruber is an assistant editor at Firstlinks and Morningstar.com.au