In my broader family, an issue that’s come up for recent discussion is about parents gifting their children money before they die instead of leaving it until after they die. As you can imagine, it’s a thorny issue. The parents reflexively believe that the money should be given through inheritance after they pass away. The children, or at least some of them, think the money would be of more value if it were given to them before that time. To them, it would be more compassionate, and might also avoid any quarrelling between the children after their parents’ deaths.

The issue doesn’t make for pleasant dinner table conversation but it’s one that’s likely to be aired more often as Baby Boomers in Australia get older, die richer and leave behind larger bequests. The Productivity Commission says Boomers – those born between 1946 and 1964 – are expected to pass on an estimated $224 billion each year in inheritance by 2050, a fourfold increase in bequests.

The question for many parents is whether to make their children wait for their inheritance or not. Today, we’ll go through the pros and cons of the issue, as well as the legal and tax implications.

The nine rules

My family discussions on inheritance have coincided with the reading of a book by a former fund manager, Bill Perkins, called Die with Zero. As the title of the book implies, Perkins believes all of us should aim to die with nothing in our bank accounts.

Why? Because for him life is about having experiences rather than accumulating money:

“Those are two very different goals. Money is just a means to an end: Having money helps you to achieve the more important goal of enjoying your life. But trying to maximize money actually gets in the way of achieving the more important goal.”

By aiming to die with zero, Perkins thinks you’ll forever change your autopilot focus from earning and saving and maximizing your wealth to living the best life you possibly can:

“Why wait until your health and life energy have begun to wane? Rather than just focusing on saving up for a big pot full of money that you will most likely not be able to spend in your lifetime, live your life to the fullest now: Chase memorable life experiences, give money to your kids when they can best use it, donate money to charity while you’re still alive. That’s the way to live life.”

Perkins outlines nine rules for achieving the aim of dying with zero:

Rule 1: Maximise your positive life experiences

Perkins reckons you should start thinking about the life experiences you’d like to have, and the number of times you’d like to have them. This will get you to focus on meaningful and memorable experiences:

“Unlike material possessions, which seem exciting at the beginning but then often depreciate quickly, experiences actually gain in value over time: They pay what I call a memory dividend.”

Rule 2: Start investing in life experiences early

If life is the sum of your experiences, then everything that you do in life adds up to who you are. Yes, you’ll need money to survive in retirement, but the main thing you’ll be retiring on is your memories. Therefore, Perkins thinks you should invest in life experiences, and start as early as you can.

Rule 3: Aim to die with zero

Perkins says that though you may not succeed in dying with zero, that should be your goal:

“People who save tend to save too much for too late in their lives. They are depriving themselves now just to care for a much, much older future self—a future self that may never live long enough to enjoy that money.”

Rule 4: Use all available tools to help you die with zero

Perkins addresses the fears of many people that they’ll run out of money before they die. He thinks if that’s a concern for you, then you need to investigate various tools including annuities – financial products that offer a guaranteed income stream.

He suggests that the other, more important part of the equation is how not to waste your life energy by underspending.

Rule 5: Give money to your children or to charity when it has the most impact

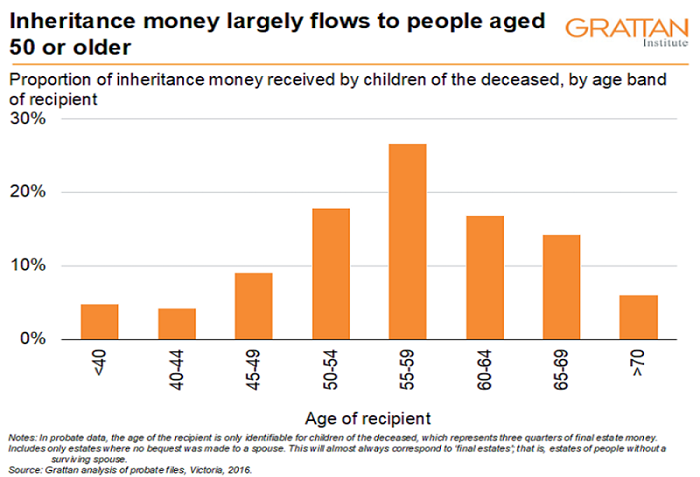

Perkins says the peak utility for money – the time when it can bring optimal usefulness or enjoyment – is around 30 years of age. Yet, the average age for inheriting money is close to age 60 for Americans and 50 in Australia (though most receive it between ages 55 and 59):

“Putting your kids first means you give to them much earlier, and you make a deliberate plan to make sure what you have for your children reaches them when it will make the most impact.”

Rule 6: Don’t live your life on autopilot

Perkins isn’t saying that you shouldn’t save for the future. Instead, he’s saying that it needs to be balanced with spending on the present.

He makes a good point that many experiences depend on your physical health. If you’ve been biding your time to go on that hiking trip, it’s best to do it now rather than later.

Rule 7: Think of your life as distinct seasons

To get more out of the present, Perkins advocates dividing your life into time buckets. That is, draw a timeline of your life from now to the grave, then divide it into intervals of five or ten years. Think about the key experiences – activities or events – that you definitely want to have during your lifetime.

Rule 8: Know when to stop growing your wealth

Often, your net worth peak – where it’s the highest that it will ever be - happens well before retirement. Perkins believes that’s the time to start spending down, or de-accumulating.

Rule 9: Take your biggest risks when you have nothing to lose

Perkin’s view is that you’re better off taking more chances when you’re younger. You’re less likely then to let irrational fears get in the way of making choices that reflect your priorities.

An older theory

Perkins' book is a modern take on an old theory. In the 1950s, economist Franco Modigliani, who went on to win a Nobel Prize, created the idea of the Life-Cycle Hypothesis. The hypothesis says that people should manage their spending and saving to get the most out of their money across their life span. Put another way, making the most out of your money throughout your life requires that wealth declines towards zero by the time of death.

As for the fear that you might run out of money, Modigliani says that to be safe, you should think about the maximum age that a person can live. He believes a rational person will spread their wealth across all the years up to the oldest age to which they might live.

The Australian dilemma

The issue of inheritance or to ‘die with zero’ is becoming more relevant in Australia as the population ages.

A 2021 Productivity Commission report found that Australians are currently passing on $120 billion each year – 90% as inheritances and the rest as gifts – with an average inheritance netting the recipient $125,000.

The report projected a fourfold increase in the value of inheritances between 2020 and 2050 “partly driven by rising wealth among older age groups” with housing wealth a significant factor, along with unspent super.

It also estimated that the ageing population will see a doubling in the number of deaths by 2050, with older people making up a larger share, and falling fertility rates meaning fewer children to leave wealth to in the future.

Productivity Commissioner, Lisa Gropp, commented that:

“By the time people receive inheritances, they’ll usually be well into middle age — about 50 years old on average. This limits the impact inheritances have on opening up lifetime choices and opportunities about career and family.”

And the report concluded that Australia’s taxation system is geared towards encouraging intergenerational transfers of housing wealth, as the family home is exempt from the pension assets test.

An earlier report from the Grattan Institute found that in Victoria, the median estate is worth around $500,000. About 20% are worth more than $1 million, and 7% are more than $2 million. Property is the largest component, accounting for half of the average value.

The main beneficiaries of ‘final’ estates – estates without a surviving spouse – are children, who get about three quarters of all inheritance money. And average inheritances are growing about 2% above the rate of inflation each year, and that’s expected to accelerate in future.

More than 80% of money passed down from parents goes to people aged 50 years and over. The most common age bracket in which people get an inheritance from parents is 55-59 years of age.

The pros and cons

The question then goes back to whether parents should consider giving their money to their children before they die. Perkins' book over-simplifies the choices that people must make. There are numerous things to examine before making a final decision. Here is a list of pros and cons:

Pros:

1. You get to see it. If you give money to your children early, you will get to see the fruits of that. Whether it’s a holiday, purchase of a home or the funding of education, helping loved ones like this can’t be overstated.

2. You may be able to give money when your children most need it. As Perkins mentioned, the peak utility for money is around 30 years of age. Instead of children inheriting it at age 50 or above, when they often don’t need it so much, it might be better to give the money to them when they require it most.

3. Potential tax benefits. Australia is one of only eight developed countries that don’t tax inherited wealth. However, there is a 17% tax on superannuation passed to a non-dependant, which is an important part of estate planning as strategies are required to take the money out of super before death. Given the current government’s crackdown on super tax breaks for the wealthy, it wouldn’t be surprising if inheritance taxes were looked at in future.

Cons:

1. You might run out of money. Despite all the research suggesting that Australians spend little of their retirement money, there’s always the fear of running out of money. And it’s understandable: you must plan and save for the future, including for unexpected spending events/decisions.

2. Tax issues. If you give money to your children, they won’t have to pay tax on that gift. But if you sell an investment to fund the gift, there may be tax consequences such as capital gains on any profit that you make on the sale.

If you decide to finance a future expense such as a grandchild’s education, you may need to consider the tax implications, as minors are subject to penalty taxes on investment income.

An alternative option that may avoid tax complications is to loan rather than gift money to your children. With a written loan agreement, you can set the terms to benefit and protect people according to your wishes.

3. May lead to more family drama. Giving money to children before you die may seem like it will reduce the prospects of inflaming family drama, yet that might not be the case. Early giving may cause resentment among loved ones who don’t receive the most of your generosity.

There can be other complications. Say you gift your child money, and they buy an apartment with the funds. They later break up with their partner, who could ask for half of the money that was put into the property purchase.

4. It can affect your age pension. Centrelink has special gifting rules to prevent people from giving money away to qualify for the age pension. It says you can only give away $10,000 in one year, or up to $30,000 spread over five years, without any effect on your pension.

For amounts exceeding this, you will still be treated as though you have held onto the money for five years. The excess over the limit will be included in your assets for the pension assets test, and you will be deemed to have earned income on it for the pension income test.

Can you get around the gifting rules by selling your home or other assets to your children at a reduced price? Centrelink says gifting also includes assets that are sold or transferred for less than their market value. If you own a home worth $600,000, and sell it to your children for $300,000, it says $300,000 will be regarded as a gift and used in calculating your pension entitlement after allowing for the permissible $10,000 gift.

Note that these gifting rules don't apply to those not on an age pension, who can gift as much as they like.

This isn’t an exhaustive list of pros and cons, and if you want to receive professional advice on the issue, please consult a financial advisor and an estate/tax lawyer.

James Gruber is an Assistant Editor for Firstlinks and Morningstar.com.au. This article is general information.