The US is facing a serious government deficit and debt crisis. Republicans and Democrats are fiddling at the margins while the debt pile grows progressively larger with each delay and short term quick fix. America has faced worse economic, financial and political crises in the past – in the 1890s, 1930s and even in the 1970s. Each of these crises brought about radical changes in policy and proved to be major turning points in America’s economic and financial history, and in each case the US economy and markets survived and prospered.

Our focus is on markets, not just economies, and in each crisis markets recovered, starting right from the middle of the crises when all hope seemed lost and pessimism was greatest.

Should the government impose strict ‘budget austerity’ to ‘balance the budget’? Or is the solution even more ‘deficit spending’, even more debt, and seemingly endless ‘money printing’?

- There is no one right or wrong set of policies that work at all times and in all situations. Inflationist full employment targeting, deficit spending and government intervention sounded like a good idea in the 1930s depression but economies collapsed in a mire of high inflation, high unemployment and stagnation in the 1970s (although it is probably unfair to sheet home the malaise of the 1970s to Keynes).

- Hard money policies of money supply targeting, deregulation and freer markets sounded like a good idea after the 1970s. Inflation was brought down and the economy and stock market boomed, but trade deficits and foreign debt soared. Low interest rates and deregulation produced a string of asset bubbles and collapses culminating in the sub- prime crash and sovereign debt crisis (likewise it is probably unfair to blame the current crisis on Hayek and Friedman).

- Severe economic, financial and political crises provide the catalyst for radical policy changes but, even when they are successful, often contain the seeds of the next crisis.

- Trying to balance the budget through piecemeal budget cuts and/or tax hikes generally just makes the deficit and debt worse, as tax revenues fall and welfare spending rise in the resultant slowdown, as was the case in 1936-8 globally and more recently in the UK and the PIIGS. It is also politically unpopular and hard to sustain in the face of popular backlashes.

- Generally it requires a very serious crisis in order to provide the catalyst and the political mandate for radical change. It generally requires either a deep external devaluation (large-scale currency depreciation, which is not possible with a fixed currency like the Euro or a strong currency like the US dollar) or deep internal devaluation (savage cuts to spending, wages and working conditions).

Should the government go even further and create budget surpluses to actually ‘pay off the debt’?

- Governments are not like individuals who need to pay off debt and create a surplus to fund retirement after income has ceased. On the contrary, governments, like companies, are perpetual and can carry a level of debt forever as long as the debt is used to finance proactive assets that will generate tax revenues that exceed the cost of the debt. Great nation-building projects like transport and energy infrastructure would qualify, but borrowing to pay welfare, government administration or the military would generally not.

- Even the Clinton budget surpluses in 1998-2000 did not actually reduce the level of government debt. The last President to actually reduce the level of federal government debt was Herbert Hoover in the 1920s boom.

- There is plenty of money in the US and plenty of scope for governments to collect more of it in tax revenues. The Clinton surpluses were achieved thanks to the 1990s dot com boom, but the dot com boom was a relatively profitless boom. US companies today are many times more profitable and today’s profits are cash profits, not the largely artificial cashless profits of the late 1990s.

- Trying for surpluses without radical reform will probably only lead to larger surpluses and more debt in the short term. Surpluses are generally only achieved from recessions after a deep crisis and radical reform.

What if the US government defaults on its debt?

- The US government has already missed payments on interest and maturing debt in the past (three times in 1979), and it has been forced to shut down departments before (in 1995 and 1996). In fact, these events turned out to be critical, but they were shrugged off by markets at first. They triggered real action, such as the 1979 defaults providing the last straw for Carter to hire Paul Volcker, and the 1995-6 shut downs being the catalyst for co-operation between the White House and Congress that produced three years of budget surpluses in the late 1990s.

- If such missed payments are selective and temporary, they are likely to be brushed off by markets as they have been in the past. The government has plenty of ways to come up with cash to keep the current process of short term delays and quick fixes going for some time yet.

- The sooner it escalates into a major crisis the sooner radical action will be need to be taken, and the sooner the real problem can be tackled and solved.

Will it ever get the economy growing again?

- Yes, the US has suffered far more severe economic contractions and financial crises in the past. Markets rebound out of the depths of the crises when pessimism is greatest and all hope seems lost.

- But radical policy changes generally require a severe crisis to provide the catalyst and the mandate for action.

- The fact that the current debt situation is only moderate and manageable means that, if the politicians can grow up and co-operate, there is time for the flood of cheap and plentiful money to translate into growth in confidence, spending, production and jobs.

Is the current level of debt too high or unsustainable?

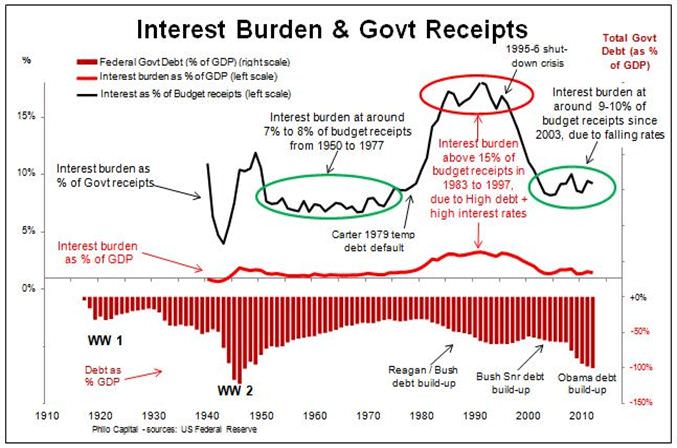

- No. The interest burden on the government debt is only moderate. Interest costs have been running at around 9-10% of budget outlays since 2003, despite the rising debt level. This is around the same interest burden from 1950 to the late 1970s, and so should be entirely manageable. The share of budget outlays has remained flat despite rising debt levels because national output and tax revenues have also been rising.

- Likewise, interest cost as a percentage of GDP is between 1.5% and 2%, similar to what it was in the 1950s to the late 1970s.

- In real terms after inflation, the interest paid on government debt ($230 billion) is lower than it has been since 1984, and is 35% lower than it was at its peak in 1996.

- Even four years of trillion dollar deficits since 2009 did not increase these debt servicing ratios, because interest rates remained low and the economy grew.

- However, as the economy improves and the Fed winds back and even reverses the bond-buying programs, yields will rise and the cost of refinancing treasuries will rise, so the clock is ticking on solving the problem.

US government debt is manageable

In summary, the US government deficit and debt problem is large but not insurmountable and is it mainly a political problem. The acrimonious point-scoring in Washington may well continue to flare up into occasional crises that are likely to include temporary defaults on interest and maturing principal, government shut-downs, selective late payments to creditors, and more credit ratings downgrades, as they have in the recent past. Most are unlikely to rattle markets seriously, and have been brushed off by markets in the recent past.

Only radical change would make sizeable inroads to the budget, on the tax side and on spending. Generally only a cataclysmic crisis is enough to provide the political mandate for wholesale and radical changes to spending patterns and tax structures. Given the moderate interest burden of the current level of debt, the most likely outlook is that game-changing cataclysmic event may be many months or years away.

The most serious threat to markets will be the fallout from interest rates rising. Rising interest rates are unlikely be caused by credit spreads and default fears if the deficit and debt situation were to deteriorate further. (Japan has more than double the debt levels and interest burden but interest rates are less than half those in the US).

Rising interest rates are more likely to be caused by a return to inflationary expectations as the economy improves, and this will most likely improve the deficit position significantly as tax receipts rise and welfare spending falls.

Another turning point, with focus on reregulation and control

The US is far better placed than the UK, Europe or Japan, in regard to both the current deficit and debt situations and also the longer term outlooks for growth and market performance.

America has experienced three great turning points in fiscal and monetary policy over the past 140 years and each arose out of the depths of a cataclysmic crisis - the 1890s depression, the 1930s depression and the end of the 1970s. Out of each crisis was born a brand new era of growth and prosperity for Americans and for investors.

But the policies and ideas that gave rise to the recovery from the 1970s crisis and drove the economy and markets for the past 30 years came crashing down in the current crisis. It is likely that America is now standing at the edge of another great turning point, as many of the underlying assumptions, conditions and policies of the past 30 years are unwinding and reversing.

De-regulation is returning to re-regulation, as the idea of small hands-off government is returning to more government influence. Central bank independence is returning to influence and control by governments and politicians. The focus on defeating inflation is returning to deliberate positive inflation targeting, and free capital movement is returning to capital controls. Tax cuts are returning to tax hikes, and free and open access to unfunded pensions and welfare ‘entitlements’ are returning to the ideas of user-pays and contribution.

It is not our role to opine on what is right or wrong. No set of policies or ideas works forever in every set of conditions, as we have seen. It is our role to study the actions and reactions of policy makers and participants that affect markets, to understand and assess likely implications and consequences, and to adjust investment portfolios to ensure preservation of capital and sustainable real growth.

Ashley Owen is Joint Chief Executive Officer of Philo Capital Advisers and a director of Third Link Investment Managers.