The coronavirus outbreak has been a tragedy for many, a shock for us all and a crisis for economies around the globe. We have embarked on a massive experiment, slashing economic activity to limit the pandemic, sharply reducing carbon emissions and preparing for only a slow resumption of growth.

A ‘green lining’ of this global crisis has been the significant reduction in carbon emissions. Figures from specialist publisher Carbon Brief estimate that carbon emissions in China fell by 25% in February alone, while the European Union could face a drop of 25% in 2020 compared with 2019 levels. Overall, it is estimated the global emission impact of coronavirus will be -5.5%, the largest annual reduction since records began.

Australian targets at risk

Despite these promising figures, in Australia, the political focus may have shifted from its commitment to climate, and its obligations to the Paris Agreement, to economic recovery, which is currently highly reliant on ‘old technology’ industries, such as mining.

While the Australian Government is currently committed to reducing emissions by 26-30% by 2030, there appears to be reluctance to prioritise green policy and initiatives, putting these ambitious targets at risk. However, following the recent bushfires and social movements, such as Black Lives Matter, Australians are demanding environmental, social, and governance (ESG) initiatives take priority with policy makers, business, and financial institutions.

The question now is whether the world can use this moment to find a ‘new normal’ and build a less carbon-intensive economic model. It’s a model that could put the temperature goals of the Paris Agreement tantalisingly within reach.

Understanding the numbers

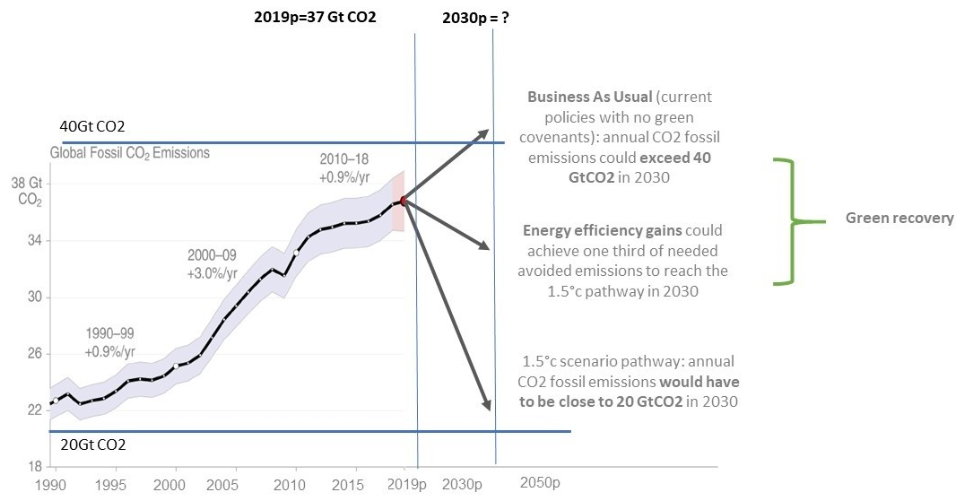

To achieve our commitment to a less-than-1.5-degree world, it would take a COVID-19-like event every year until 2050. Starting next year, yearly emissions cuts should be more than 7% and emissions need to peak as soon as possible. If negative emissions technologies are excluded, or fail to become available at scale, then the required emissions reductions for a 1.5-degree world would be an eye-watering 15% every year until 2050, according to the UNEP Gap Report 2019.

Chart: Evolution of CO2 emissions from 1990

Sources: AXA IM estimates, Global Carbon Project, CDIAC, Friedlingstein et al, 2019

It is a sobering thought that over the next couple of decades, we need to replicate and enhance the forced effects of the last few months. This crisis has offered policy makers and investors a rare opportunity to construct a recovery that builds on the progress already made.

The role of policy in economic growth and global warming

One clear point about the hit to global GDP, which is forecast in the IMF World Economic Outlook (April 2020) to contract by -3% this year, is that it is hoped to be temporary. That means the drop in global carbon dioxide emissions will likely be temporary too. Try as we might, to date, we have not yet uncoupled economic growth from global warming.

To create change, an obvious step is to redouble efforts to shift the energy mix. Renewable energy (including wind, solar and bioenergy but not hydro) is growing exponentially (+13.8% per year between 2013 and 2018). However, growth has been too low to offset the increase in fossil energy consumption (+1.5% of oil and +2.6% for gas over the same period) which still dominates. Growth in renewables has outpaced growth in all other forms of energy since 2010 but the share of fossil fuels in global primary energy demand remains above 80%.

Another effective tool for change is through bailouts and stimulus, which governments are offering to support economic activity in the post-crisis environment. Governments can deploy green stimulus to condition business support on a decarbonisation criteria.

Investing for change

Investors can help to build a greener economy through investing in positively evolving businesses and scaling up their company engagement agenda and stewardship commitments.

In 2019, climate change accounted for more than 40% of AXA IM’s total engagement with companies. In a 12-month period, we engaged with 217 issuers, voted at 6,016 general meetings, and 64,439 proposed company resolutions were voted on. This was an increase of engagement by 74% from 2018 levels.

Industry bodies and working groups are also an effective tool for driving conversation and change on the climate agenda. An example is the European Alliance for a Green Recovery, which brings together a coalition of policy makers, companies, trade unions and financial institutions to develop a recovery package that accelerates the transition towards climate neutrality and a healthy eco-system. Proposed concrete solutions include the ‘European Climate Emergency Fund’, which would issue debt instruments whose proceeds would be used to fund green transition projects undertaken by governments or corporations.

The Climate Action 100+ initiative is one of the best-known investor coalitions and engages with the most carbon intensive companies in the world on climate related issues. It has been mostly focused on energy supply sectors, so far, but engagement opportunities still exist in the end-use consumption sectors.

COVID delivers an opportunity for change

It is everyone’s responsibility to forge a ‘new normal’ and capitalise on the significant emissions reductions from COVID-19. To create change, government needs to harden policy thinking and investors need to invest responsibly and proactively engage with companies.

We have been given a glimpse of the kind of adjustments our world needs to make if we are to definitively tackle the looming threat of the climate crisis. Far from distracting us from this, COVID-19 should harden our resolve while teaching us valuable lessons.

Lise Moret is Global Head of Climate Change Strategy at AXA Investment Managers. The full version of this article is linked here.