During the [third] quarter, we added ResMed (RMD.ASX) to our top ten holdings. ResMed is the global leader in sleep and respiratory care primarily focused on the development and sale of positive airway pressure devices and accessories for the treatment of obstructive sleep apnoea. ResMed’s share price has fallen 30% since the release of its FY23 results in August largely in response to concerns GLP-1 (Glucagon-Like Peptide-1) drugs may reduce its addressable market. In this article, we discuss the business in more detail and why we think the GLP-1 concerns are overdone.

What is Obstructive Sleep Apnoea (OSA)?

Obstructive sleep apnoea is a chronic illness that occurs when the muscles that support tissues in the back of the throat relax during sleep, blocking or narrowing the upper airway. This obstruction leads to impaired breathing for a short period (usually 10-20 seconds), which results in lower oxygen in the blood. The brain senses the impaired breathing, causing the individual to subconsciously rouse from sleep in order to reopen the airway. The severity of OSA is characterised by the number of events per hour: Normal < 5; Moderate 15-30; Severe > 30.

Continuous Positive Airway Pressure (CPAP) devices are the accepted standard of care for treating OSA, delivering a stream of pressurised air through a mask to prevent the collapse of the upper airway during sleep. ResMed is the largest manufacturer of these products, and we estimate the company currently has ~80% market share with its major competitor Philips out of the market for the past two years due to an FDA-imposed product recall.

Large, undiagnosed addressable market

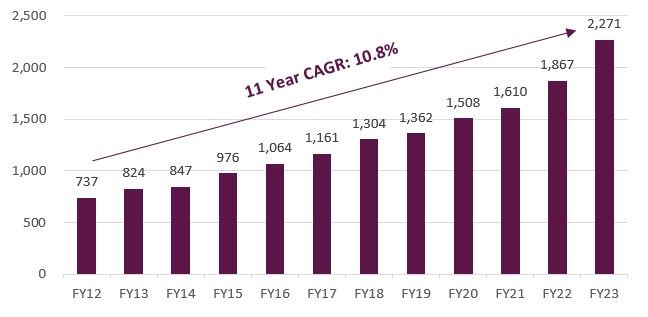

The OSA market is large and mostly undiagnosed. According to the company, there are 936 million people globally with sleep apnoea and 424 million of these suffer from severe sleep apnoea. The size of the addressable market is evidenced by the fact ResMed had grown its device revenue at over 9% p.a. in the six years prior to the Philips recall (FY13-FY19). Recent growth rates have been even higher. ResMed estimates that penetration currently sits at 20% in the US and well below this percentage globally, which implies a long runway for future device and mask sales.

Figure 1 – ResMed device revenue (US$)

Source: Company filings

One of the highest-quality companies on the ASX

As with any new position, we tested ResMed against our key investment criteria and consider the business to be high quality based on the following factors:

- Financial strength: ResMed has a strong balance sheet with less than 1x ND/EBITDA

- Business quality: ResMed has a dominant market position (~80% share), sells defensive products that improve patient quality of life and are reimbursed by Medicare/health insurers in the US, and earns high returns on capital (22% average over last 5 years).

- Management quality: We consider ResMed a “founder-led” business. Founder Peter Farrell is Chair Emeritus, and his son, CEO and Chair Mick Farrell, has presided over an exceptional track record in product development and market share gains in his 10+ years as CEO.

GLP-1 concerns and valuation

ResMed has historically traded on a forward multiple of 28x PE but is currently trading on less than 21x PE due to market concerns about GLP-1 drugs reducing ResMed’s addressable market.

Figure 2 – ResMed NTM Rolling PE

Source: FactSet

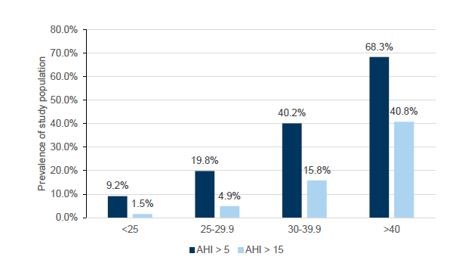

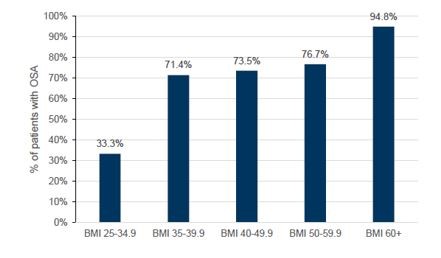

GLP-1 drugs (branded as Ozempic, Wegovy and Mounjaro) act by mimicking hormones that are released into the gastrointestinal tract in response to eating. These drugs were initially developed to target type 2 diabetes by stimulating more insulin production but have evolved to potential applications in weight management and cardiovascular indications. Given obesity is a key risk factor for OSA (see Figures 3 and 4), there is a view that significant weight reduction from taking GLP-1s may result in reduced demand for CPAP therapy.

Figure 3 – OSA severity by AHI (>5 mild) and (>15 moderate)

Figure 4 – Prevalence of sleep apnoea in morbidly obese patients who presented for weight loss surgery evaluation

Source: Goldman Sachs Research

While we are not medical experts, we consider the significant de-rating to be an overreaction for the following reasons:

- GLP-1 drugs have been around for almost a decade in managing blood sugar, and other competing therapies such as oral devices and bariatric surgery have not been able to displace CPAP as the standard of care. We note CPAP also has the advantage of being able to track patient adherence and compliance through cloud-connected devices. We believe this data is valuable to third-party payors.

- While we acknowledge weight gain is a leading risk factor in developing OSA, it is not the only cause. Based on our conversations with sleep physicians and the company we estimate one-third of OSA patients are not obese. While the remaining two-thirds of the patient pool is highly likely to test GLP-1 drugs (as they become more accessible and affordable) we don’t expect adherence to be 100% given the potential for side effects such as nausea and the impact on lifestyle. We also don’t expect GLP-1s to fully eliminate OSA in all cases (the drugs may simply reduce severity). As a result, we think it’s more likely you could have a scenario where a combination of GLP-1 drugs and CPAP therapy are prescribed as treatment.

- Finally, these drugs with an average retail price of ~US$1,000/month are currently unaffordable for most patients. Pricing will need to come down significantly to attract broader reimbursement and mass adoption.

Overall, we think the uncertainty as to the potential penetration and success of these drugs in treating OSA has created a rare opportunity to invest in one of the highest quality companies on the ASX. While we are unlikely to pick the bottom, we believe the company is trading well below its intrinsic value.

Vinay Ranjan is a Senior Equities Analyst at Magellan-owned, Airlie Funds Management. Magellan Asset Management is a sponsor of Firstlinks. This article has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not consider your investment objectives, financial situation or particular needs.

For more articles and papers from Magellan, please click here.