Dividend-income strategies can be effective provided they’re designed to tap into a wider opportunity set beyond traditional dividend payers alone.

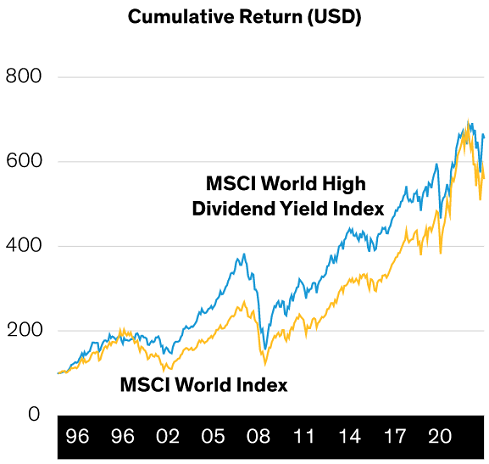

Dividend stocks: Long-term outperformance, but episodic returns

Past performance does not guarantee future results. As of December 30, 2022. Source: MSCI and AllianceBernstein (AB).

Traditional dividend stocks: the risks of a narrow focus

Dividend-income strategies play an important role for multi-asset income portfolios. But they can also run the risk of being too narrowly focused, which can limit both income potential and upside participation when equity markets rise.

Traditional dividend strategies tend to be more defensive, outperforming when economies slow. That’s because companies able to pay high and consistent dividends are often more mature, with relatively stable business models and stronger balance sheets, which can help them navigate periods of market stress.

However, investing solely in traditional dividend-paying companies could sacrifice returns through some parts of the cycle. Dividend-payers tend to have value traits and, as a result, are natural competitors to high-growth companies that reinvest profits to expand their business instead of returning them to shareholders. Therefore, when growth is more rewarded, dividend payers tend to lag.

For these reasons, we believe a more thoughtful and diversified approach to dividend investing makes sense.

The dividend income universe faces a growing challenge

Recent market dynamics have also highlighted how leaning purely into high-dividend stocks can come with larger-than-usual unintended risks that need to be carefully managed.

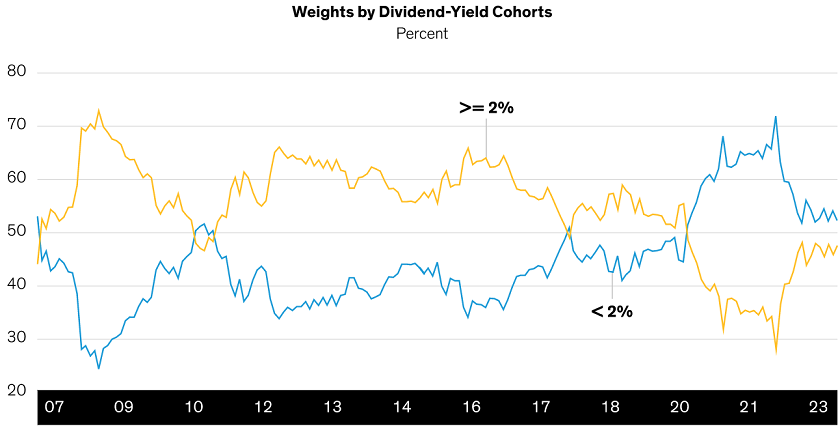

For instance, the rise in market capitalizations of fast-growing, often tech-focused companies has created an environment where less than half of the global universe is paying a dividend over 2%. This has shrunk the opportunity set for traditional dividend investors—we think this underscores the need for income seekers to expand into other areas of the equity market.

Less than half of global stocks pay a dividend of over 2%

Past performance does not guarantee future results. As of February 28, 2023. Source: MSCI and AB.

This large divide between high-growth companies and traditional dividend payers is changing the behavior of the dividend-stock universe, which is acting more defensively than usual, with steadily declining sensitivity to the broader equity market. This trait helped in 2022’s challenging market but is likely to reduce upside participation when markets deliver strong returns. This was true in 2020’s growth-led rally, when dividend stocks underperformed by around 16%; a similar downtrend is also unfolding in 2023.

We believe that the approach to dividend investing in today’s market should be designed to counter some of these challenges.

Beyond payouts: Factors help expand the dividend-investing universe

In our view, a quantitative-driven process can be an effective way to include stocks that would typically be beyond the universe of traditional dividend strategies. A more systematic approach can better harvest yield across countries, styles and sectors. It also helps to assess stocks based not just on dividend yield, but also on additional risk premia like price momentum, quality and earnings strength, which can help build a more well-rounded portfolio.

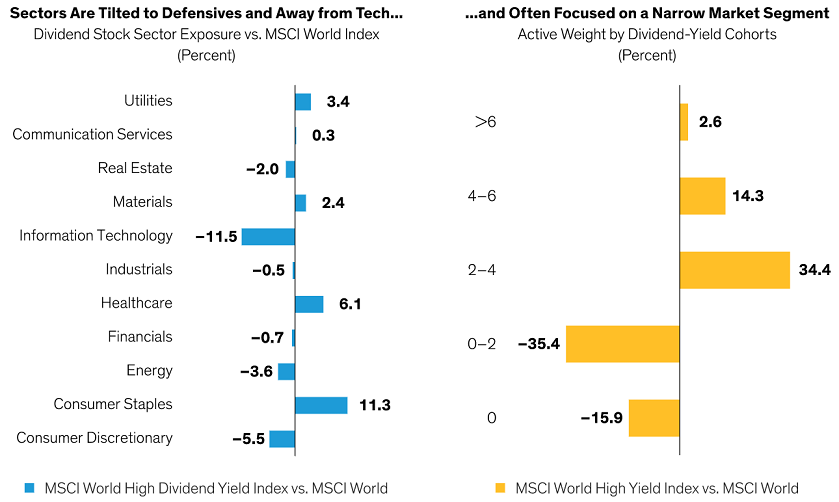

Casting a wider net may help to avoid unintended concentrations in style factors, sectors and narrow ranges of dividend levels, an increasingly likely result when focusing on traditional dividend payers alone. Big swings in sector returns can be more common, and their dispersions dominate most other factors in investment performance. This trend accelerated with the COVID-19 pandemic “winners and losers” of 2020 and 2021, with technology dominating all other sectors; in 2022, concerns of high inflation and rising interest rates took center stage, leading energy to outperform, while more defensive sectors such as healthcare and consumer staples retreated far less than others.

The growing shift in sector composition between the broad equity market and traditional dividend payers, along with the greater dispersion in industry leaders and laggards, has led to larger than usual differences in short-term performance between high-dividend and broad market indices. For some investors focused purely on income, this could mean their returns will deviate more than usual from core equity performance.

A more systematic approach to dividend-investing can help to reduce sector differences, most notably with a lower structural overweight to consumer staples and—crucially—a minimal underweight to technology, which can help to minimize tracking error versus the broader equity market.

Traditional dividend approaches could lead to unintended exposures

Past performance does not guarantee future results. As of February 28, 2023. Source: MSCI and AB.

The dynamics of dividend investing in an income strategy

Dividend stocks are one of many important building blocks in a multi-asset income strategy. Investors should constantly weigh how a dividend-income allocation complements other building blocks as market patterns evolve. For example, investors should consider the relative yield advantage between stocks and bonds when assessing the role of dividend equities.

Just 18 months ago, high-dividend equity yields were more than double those of high-quality bonds and generating almost the same income as high-yield bonds. Today, bonds offer considerably more income than equities: high-yield bonds offer twice the yield of stocks, while high-grade bonds offer a yield advantage of more than 1%. In this environment, it’s more important than ever for equities to provide room for capital appreciation alongside their dividend income.

We believe that by taking a more systematic approach and thoughtfully combining stocks across the income spectrum while also balancing sectors and other types of risk premia, investors can capture an attractive level of dividend income without sacrificing return.

Karen Watkin, CFA is a Portfolio Manager—Multi-Asset Solutions, Eugene Smit, CFA is a Portfolio Analyst and Manager—AB Hedge Fund Solutions, Cherie Tian, CFA is a Portfolio Manager—Systematic Equity, and Edward Williams is a Product Manager—Multi-Asset Solutions for AllianceBernstein. Its listed fund is AB Managed Volatility Equities Fund (Managed Fund) – MVE Class (AMVE).

Note to Readers in Australia and New Zealand (click to view):

This document has been issued by AllianceBernstein Australia Limited (ABN 53 095 022 718 and AFSL 230698). Information in this document is intended only for persons who qualify as “wholesale clients,” as defined in the Corporations Act 2001 (Cth of Australia) or the Financial Advisers Act 2008 (New Zealand).

Information, forecasts and opinions set out in this document are not personal advice and have not been prepared for any recipient’s specific investment objectives, financial situation or particular needs. Neither this document nor the information contained in it are intended to take the place of professional advice. Please note that past performance is not indicative of future performance and projections, although based on current information, may not be realised. Information, forecasts and opinions (“Information”) can change without notice and neither AllianceBernstein Investment Management Australia Limited (ABN 58 007 212 606, AFSL 230 683) (“ABIMAL”) or ABAL guarantees the accuracy of the information at any particular time. Although care has been exercised in compiling the information contained in this report, neither ABIMAL or ABAL warrants that this document is free from errors, inaccuracies or omissions. For Investment Professional use only. Not for inspection by, distribution or quotation to, the general public. This document is released by AllianceBernstein Australia Limited ABN 53 095 022 718, AFSL 230 698.