Australia’s SMSF retirees should change their thinking about spending their savings to determine the best strategy for retirement, according to new research presented at the recent SMSF Association national conference. The 'GPS Framework' (Grow, Preserve, Spend) helps SMSF retirees set a direction for consumption of their retirement capital.

Melanie Dunn, Accurium’s SMSF Technical Services Manager speaking

at the 2018 SMSF Association National Conference in Sydney.

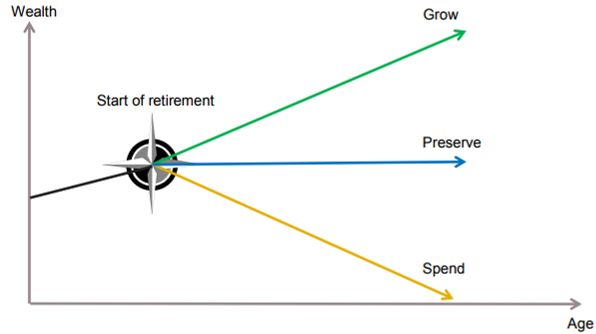

As people retire the key question changes from ‘Have I saved enough?’ to ‘How much can I spend from these savings?’ To answer this question, the retiree should consider whether their goal is to Grow, Preserve or Spend their savings over retirement.

Chart 1: GPS Framework: setting a direction for retirement spending

At one extreme are people with more than enough who will continue to grow their wealth during retirement. At the other extreme are those who don’t have enough to last and will run out of money. In between are the options of trying to preserve the value of the initial wealth or taking a path that maximises consumption but leaves little or nothing for the next generation.

Are SMSF retirees Growers, Preservers or Spenders?

The Accurium report considers the proportion of SMSF households that fall into the different segments of the GPS Framework. This assessment requires an understanding of the household’s desired spending level and amount of savings at retirement to support that lifestyle.

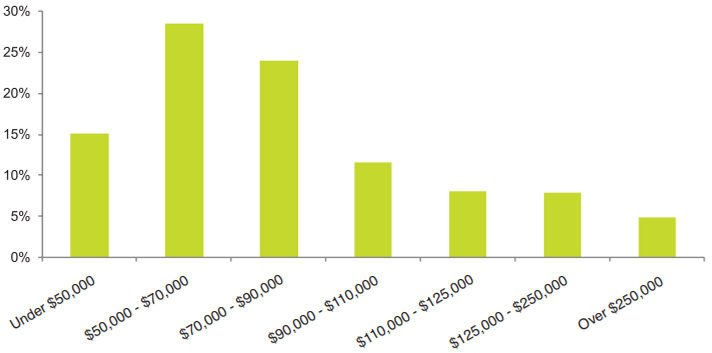

Accurium’s retirement healthcheck is a retirement planning tool that assesses the likelihood of retired households being able to meet their retirement spending goals. Analysis of nearly 800 SMSF households’ detailed retirement plans over the year to June 2017 showed a range of desired annual spending levels.

Chart 2: Desired annual spending levels in retirement for SMSF trustees

The ASFA Retirement Standard identifies approximately $60,000 per annum as a sufficient budget to enjoy a comfortable standard of living in retirement for a couple. The median spending level in retirement for SMSF couples in the Accurium database was $80,000.

While some households are spending at the ASFA standard or less, other SMSF households are looking forward to a more aspirational lifestyle in retirement. Accurium’s research showed 24% of SMSF couples aiming to spend over $100,000 per annum.

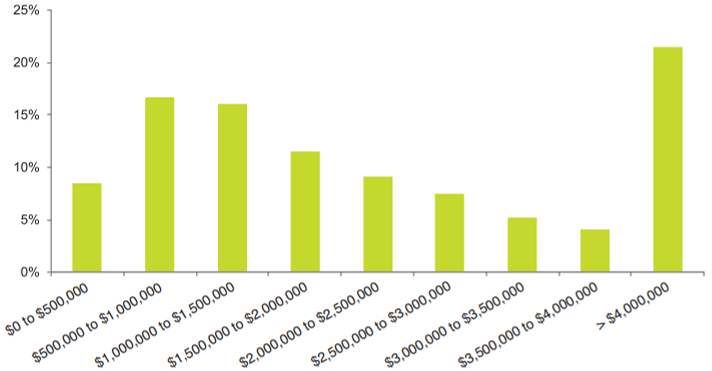

Accurium’s research also suggests that, on average, an SMSF couple might have about 35% of their total retirement savings outside the SMSF. Using SMSF asset data from their actuarial certificate database of over 60,000 SMSFs from the 2015-16 tax-year, Accurium estimated the proportion of 65-year-old SMSF couples with different balances.

Chart 3: Estimated distribution of total savings at retirement for SMSF couples

SMSF retiree balances are typically larger than those of members of other superannuation funds. Accurium estimated the median balance at June 2016 for a two-member SMSF at retirement was around $1,137,000. This is about four times the level of an average APRA-regulated household approaching retirement. The median couple with $1,137,000 in their SMSF therefore might have total retirement savings of around $1,750,000.

Our research shows that about 25% of SMSF retiree couples are Growers, who will increase savings in retirement, 28% are Preservers who will retain the majority of the value of their savings, and just over 20% are Spenders who will spend most of their savings across their retirement, based on a typical SMSF retirement spending goal of $80,000 a year. The remaining 26% are at risk of running out of savings during retirement and might need to spend less so that their money lasts as long as they do.

However, it varies by annual expenditure. While 38% are Growers, 35% Preservers and 18% Spenders at $60,000 a year spending (the ASFA ‘comfortable’ standard), this declines to 18%, 25% and 18% respectively at a more aspirational $100,000 a year spending level because they are spending more of their retirement savings.

Using the GPS Framework when setting retirement income strategies

Accurium’s research concludes that in retirement, it is the level of spending rather than investment returns which is the primary determinant of retirement outcomes. SMSF households can utilise the GPS Framework to assess whether their retirement spending is aligned with their goal to Grow, Preserve or Spend retirement savings.

“Many SMSF retirees adopt similar financial strategies when it comes to spending but this report highlights that retirees should think differently”, says Accurium’s General Manager, Doug McBirnie. “The amount they can spend and the appropriate retirement strategy depends on where they sit in the GPS Framework. The financial risks faced are different in each segment and the GPS Framework can provide a guide for retirees when it comes to setting their retirement income strategy.”

The report suggests that a simple bucket approach to generating retirement income might be appropriate for the limited risks faced by Growers. However, a more detailed cashflow strategy might be needed for Preservers who are more exposed to market timing risks, while Spenders need to focus more on managing the risk of outliving their savings and should consider the benefits of an income layering approach to ensure they have enough to continue to meet their needs.

The full GPS Framework is linked here.

Melanie Dunn is SMSF Technical Services Manager at Accurium, a sponsor of Cuffelinks. This article is general information and does not consider the circumstances of any investor.