Investment trends can sometimes be hard to pick, but the huge and ongoing investor cash inflows into Exchange Traded Funds (ETFs) that invest in fixed income securities such as government and corporate bonds is difficult to miss.

Fixed income inflows are currently running at a record pace, largely thanks to deteriorating economic conditions that have spurred a spike in interest rates. Higher interest rates are translating into higher fixed income returns.

Over the first half of this year, investors in the United States poured US$99.4 billion (A$144.3 billion) into fixed income ETFs, according to Morningstar. Meanwhile, European demand for fixed income ETFs hit record levels as investors added US$36 billion (A$52.2 billion) into listed bond funds.

Australian fixed income inflows also surged over the six months to 30 June 2023, according to data from the Australian Securities Exchange (ASX) and separate data from Vanguard. In Australia, the combined inflows into Australian-listed ETFs that invest in bonds exceeded the inflows into ETFs that invest in domestic and global shares. That’s despite the strong first half rally on global equity markets, including on the ASX.

Collectively, investment inflows into Australian and global fixed income ETF products totalled $2.49 billion over the first half, which compared with inflows of $1.56 billion into Australian and global equity ETF products.

SMSFs become more defensive

This uplift in fixed income inflows is also likely to extend to the investments being made by Australia’s self-managed superannuation fund cohort.

The 2023 Vanguard/Investment Trends SMSF Investor Report, released in June, found that many SMSF investors had started to increase their allocation to defensive assets in general. Conducted between February and March 2023, the annual report now in its 18th year represents the largest scale quantitative survey of Australian SMSF investors.

According to the report, one in five SMSFs acknowledge that the prevailing economic conditions have had a significant impact on their approach in selecting investments, with over a third of SMSFs indicating an increased allocation to cash and cash-like products.

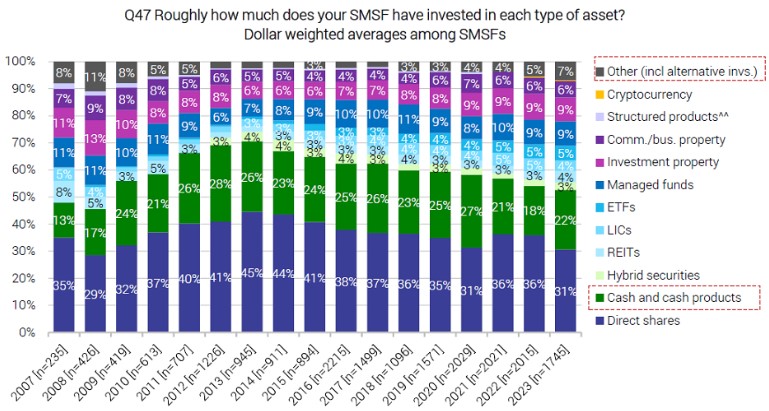

Direct shares have seen the largest relative decline in terms of SMSF asset allocation on a dollar-weighted basis. Of the SMSF survey respondents, 36% said they had rebalanced their investment portfolio in the past year by between 10% and 50%. This had resulted in their average asset weighting to direct shares declining from 36% in 2022 to 31%, as shown below.

The primary reasons cited for this were because SMSF trustees had adopted a more defensive stance and had a negative outlook on overseas shares. With the current unsettled economic landscape of high interest rates and inflation, capital protection remains a priority for most SMSFs.

It is typical to see increased allocation to defensive assets such as fixed income or cash products during uncertain times. With interest rates rising, the data suggests SMSFs are favouring assets that they see as low risk.

The bottom line on cash

There is a common misconception that cash is a risk-free asset. While it is not prone to daily market volatility like shares are and is highly liquid, cash does have inherent investment risks.

A decade of record-low interest rates has meant that cash as an asset class has delivered an average annualised income return of just 1.9% since 2012. That’s lower than any other major asset class.

Worse still, after taking high inflation levels into account, hovering between 5% and 7% at time of writing, real cash returns have been negative for some time.

Although rising interest rates have created short-term pain for Australian investors, they have helped to improve long-term return expectations for bonds.

While bond prices typically reprice lower when interest rates rise, investors with a sufficient long-term investment horizon will ultimately be better off.

Investors are also flocking to bonds in their search for diversification and income as yields continue to stabilise (a signal that investors are becoming more optimistic), presenting an attractive alternative to holding cash which has generally underperformed bonds post rate hike cycles.

Being slightly higher-risk than cash, bonds are generally expected to outperform cash over the long term. As of June this year, Vanguard’s median annualised return expectations for Australian and global bonds ex-U.S (hedged to Australian dollars) over the next decade were 3.4% to 4.4%, and 3.6% to 4.6%, respectively.

Balaji Gopal is Head of Personal Investor and Financial Adviser Services at Vanguard Australia, a sponsor of Firstlinks. This article is for general information purposes only and does not consider the circumstances of any individual.

For more articles and papers from Vanguard Investments Australia, please click here.