Whether you are an investor or borrower you will know that rates are rising. On 1 July 2022, the Aged Care Interest Rate (better known as the Maximum Permissible Interest Rate or MPIR) jumped from 4.07% p.a. to 5% p.a. It’s the biggest change in rate since the GFC which saw the rate drop from 11.31% p.a. to 8.76% p.a.

Who is affected by the rate change?

The new rate applies to people who enter aged care from 1 July 2022 and existing residents who move to another home. Existing residents who are paying the market price for their accommodation will also be subject to the new rate if they choose to move rooms in their current aged care home.

The majority of people who live in aged care pay the market price, determined by a means test that uses a combination of your assets and income. Generally, if you have assets (which includes your home unless it’s occupied by a ‘protected person’) worth more than $178,839 then you will pay the market price. Low means residents are typically people who don’t own a home, or their home is occupied by a protected person, and their other assets are below $178,839.

A protected person includes;

- Your partner or dependent child.

- Your carer, who has lived in the home with you for the last two years or more, and is eligible for an Australian Income Support Payment (for example Age Pension, Disability Support Pension or Carer Payment).

- Your close relative, who has lived in the home with you for the last five years or more and is eligible for an Australian Income Support Payment.

If you are not sure whether you will be a market price or low means resident, you can use the Government’s My Aged Care Fee Estimator to calculate your fees or you can submit a Calculation of your cost of care form to Centrelink.

The effect of the change in interest rate will also depend on whether you will pay for your accommodation by a lump sum, daily charge or a combination. The aged care interest rate is used to determine the Daily Payment for market price residents and the lump sum for low means residents.

Most residents choose to pay a Daily Payment or a combination, there are lots of reasons for this including not wanting to sell the family home for sentimental reasons. Financially speaking, keeping the home can also have benefits because it has a capped value of $178,839 for the aged care means test and a 2-year asset test exemption for calculating your Age pension.

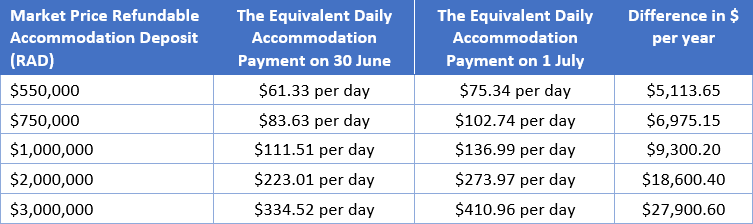

Let’s say you are a market price resident who has an aged care bed worth $550,000 and you are going to pay by Daily Payment on 30 June it will cost $61.33 per day but if you moved on or after 1 July the same bed will be $75.34 per day, that’s a difference of $5,114 per year. If the market price was $1 million the difference would be $9,300 per year and if you choose the most expensive aged care bed the difference could be $27,900 per year.

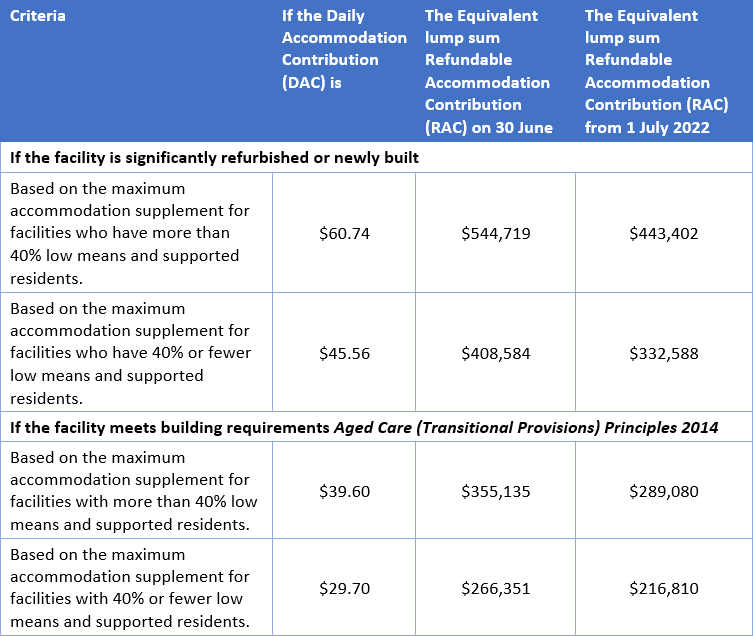

If you are a low means resident, then moving after 1 July would mean the same Daily Payment but a lower lump sum. If your daily payment is $50 the lump sum equivalent on 30 June is $448,403, but if you move on or after 1 July it will be $365,000.

With many economists tipping multiple rate rises over the coming year it seems that these trends – daily payments becoming more expensive for residents paying the market price and lump sums becoming cheaper for low means residents – are likely to continue.

Impact of 2% further rise

If we assume the MPIR reaches 7%, the market price resident above paying $550,000 by daily payment will pay $105.48 per day, an increase of $11,001 per year from today’s price. For the low means resident with a daily payment of $50 the lump sum equivalent will be $260,714.28 which is $104,285 less than today.

If you or a loved one are considering moving into aged care, it is worth seeking advice from a Retirement Living and Aged Care specialist.

Rachel Lane is the Principal of Aged Care Gurus where she oversees a national network of adviser dedicated to providing quality advice on retirement living and aged care. She is also the co-author of a number of books with Noel Whittaker including the best-seller 'Aged Care, Who Cares?' and their most recent book 'Downsizing Made Simple'. To find an adviser or buy a book visit www.agedcaregurus.com.au.