The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

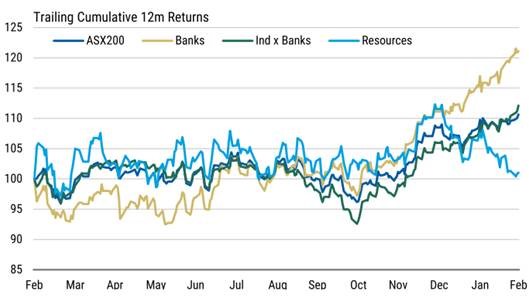

Australian banks have had a great run of late, compared to both the ASX 200 and other major sectors.

Source: Morgan Stanley, courtesy of Clime Asset Management

Commonwealth Bank (CBA) has stood out. It was largely flat for seven months into October last year, before exploding higher in recent months. Over the past 12 months, its share price has climbed 23% versus the ASX 200’s 8%.

Source: Morningstar

What’s behind the move? It’s largely on expectations of an economic ‘soft landing’, rates cuts, and a resilient consumer. Throughout most of last year, investors were concerned about the fixed mortgage rate cliff, how rising rates would impact consumers and their spending, and whether the economy could hold up given these headwinds. Markets seem to be suggesting that those worries were overblown and that the economic picture is more positive for 2024.

Welcome to the most expensive major bank in the developed world

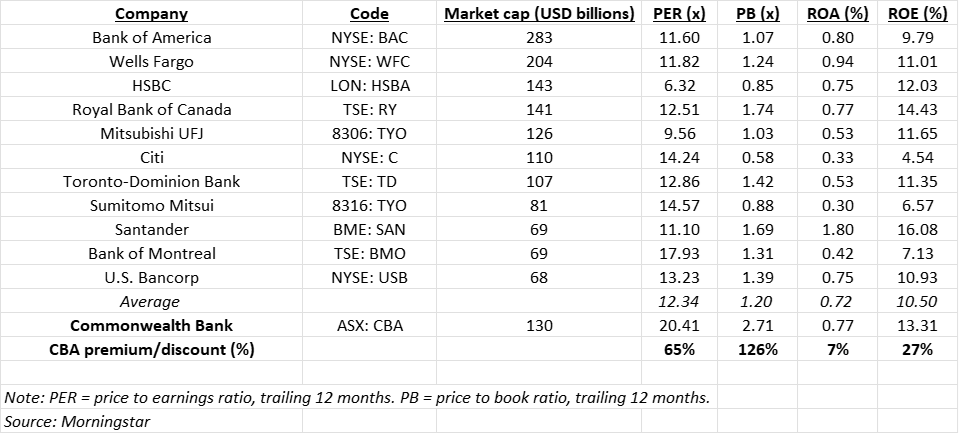

I thought it’d be a useful exercise to compare our largest bank, CBA, to other global retail banking peers to see how it stacks up on valuations and returns. Here’s a summary of the key numbers.

Table 1: Major global retail bank valuations and returns

CBA is now the 12th largest bank in the world. In the table above, I’ve excluded investment banks such as JP Morgan and Morgan Stanley, which have large market capitalisations versus CBA. I’ve also excluded state-owned Chinese banks, which have low valuations from poor transparency and all of them are dealing with property loans going bad due to the country’s deflating housing market. And I haven’t included some of the Indian banks as they still operate in a developing market where growth and returns are plentiful, and valuations reflect that.

The companies left on the list are those principally in developed markets - including Europe, Japan, Canada, and the US – and are operating retail banking franchises.

What does the table tell us? CBA is arguably the most expensive retail bank in the developed world. The price-to-book (PB) ratio is the principal valuation metric used for banks, and CBA’s current PB ratio of 2.71x is at a 126% premium to the global peer average. No other developed market retail bank comes close to CBA on this metric, with the Royal Bank of Canada valued the next highest at 1.74x PB.

On a price-to-earnings ratio (PER) basis, the valuation gap is less extreme though still notable. CBA’s PER of 20.4x is at a 65% premium to global peers. Again, no other peer comes close to CBA, with the next highest being the Bank of Montreal at 17.93x PER.

Looking at valuation alone doesn’t tell the full story, though. We need to look at the returns of CBA to see whether the premium valuation accorded it is justified.

Return on equity (ROE) is the most common metric used to evaluate a bank’s returns. CBA’s ROE of 13.3% is 27% better than the global peer average. There are two banks with higher ROEs, namely Santander (16.1%) and Royal Bank of Canada (14.4%).

Return on assets is likely a better indicator as it measures how effective a company is at using their assets to create value, but minus the leverage which can boost ROE figures. On this score, CBA’s ROA of 0.77% is closer to the middle of the pack, at a mere 7% above the global peer average. Santander and Wells Fargo stand out on this metric.

All up, the table suggests that CBA’s returns are above the average of other major retail banks, but its valuation is way above comparable peers.

How does CBA stack up against other local banks?

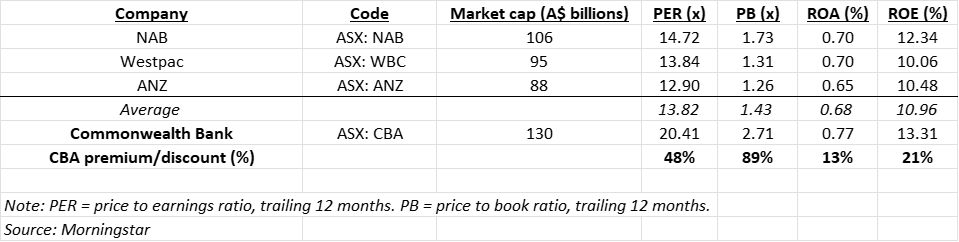

A global snapshot is useful, though a local one is necessary too. Here is the same table, though just for the major Australian retail banks (I’ve left out Macquarie Bank as it’s an investment bank).

Table 2: Major Australian retail bank valuations and returns

Again, CBA’s premium valuations are striking. On a PB ratio basis, CBA’s PB of 2.71x is at an 89% premium to the average of the other three majors. And on a PER basis, CBA’s PER of 20.4x is 48% higher than the average 13.82x of the other banks. When it comes to valuations, no other Australian bank comes close to CBA.

As for returns, CBA’s ROE and ROA are 21% and 13% superior to the average of the remaining three banks.

While the disparity between valuations and returns for CBA against Australian peers is less stark than against international banks, it’s still significant.

Is CBA’s premium valuation justified?

While numbers such as these are helpful, it’s good to delve deeper into the reasons why CBA may or may not deserve a better valuation than other retail banks.

Let’s look at the strengths of the bank:

1. It operates in a bank oligopoly. The structure of the banking industry in Australia is the biggest strength for all the major banks, including CBA. The ‘four pillars’ policy prevents any of the four major banks from taking over each other, which eliminates the prospect of competitors merging to gain scale and competitive advantages. It effectively backstops the domination of the big four banks and limits competition, which improves returns on equity.

The banking market most like Australia is probably Canada. The large retail banks there have also enjoyed decades of high returns on capital and rewarding shareholder performance.

Contrast this with the US, which has more than 4,000 commercial banks (versus 62 locally owned ones in Australia). Bank competition is much stiffer in America, and the retail bank returns are generally lower.

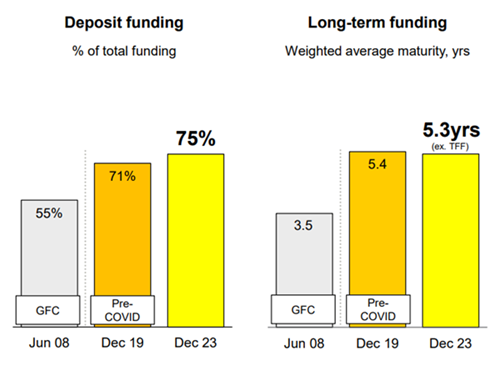

2. CBA is the deposit king. CBA has 16 million banking customers and 10.9 million transaction accounts, giving it the largest deposit funding pool of any Australian bank. It allows CBA to have access to cheap and sticky funding for its business. Close to 75% of total funding comes from deposits, with the rest from securitization, hybrids, and wholesale funding.

Source: CBA

3. Home loan stranglehold. Most of CBA’s loans are home loans, which are considered the safest of loan types (more on that later). And it has a 25% share of the home loan market, well ahead of the second largest lender to this segment, Westpac.

4. Sound credit quality. The quality of loans is sound at this stage. Just 0.52% of home loans are in arrears, and CBA seems well provisioned for potential bad debts in future.

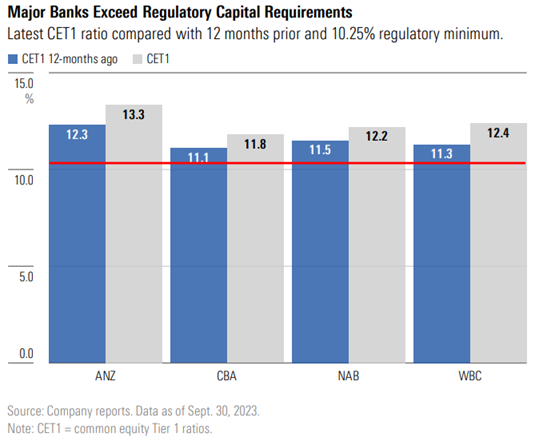

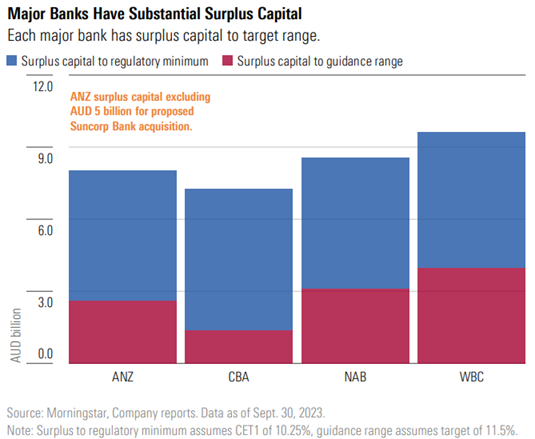

5. Sound capital position. CBA is well capitalized with a common equity tier 1 ratio of 11.8%, well above the regulatory minimum of 10.25%. APRA’s push for greater capital to be held by banks post-GFC leaves all of them, including CBA, in a strong position.

6. Technology lead? Fund managers and analysts often talk of CBA’s lead in technology over competitors, though my direct experience with the bank has me scratching my head on this one. It may be true, though I haven’t seen it from my end.

CBA’s weaknesses

1. Unexciting growth prospects. Thanks to a spectacular housing boom, loan growth for the banks has been buoyant for much of the past four decades. It’s slowing now and is highly unlikely to get back to anything like the growth of the recent past. CBA housing loan growth was just 0.1% in the most recent quarter.

2. Loan competition. Recently, Macquarie Bank has ramped up competition in the home loan market. CBA has chosen to not match some of the aggressive pricing of Macquarie Bank and others. While it’s not intense competition as some make out it to be (intense for Australia, perhaps), it is a near-term headwind for CBA.

3. Deposit competition. With rising rates, competition for deposits has heated up. Yet, this issue shouldn’t be overstated, as deposits are traditionally sticky, and CBA has a stickier franchise than other any bank.

4. Exposure to stretched housing market. CBA is all in on housing, and it remains its biggest current strength, but also its largest risk. I’ve previously argued that housing in Australia is likely priced more expensively than any other asset in any part of the world – even more expensive than the Magnificent Seven tech stocks. Any downturn in housing would increase bad debts and hurtt profits.

5. Commoditised products. This isn’t a CBA issue as it’s common to all retail banks. That is, banks offer commoditized products with little in the way of differentiation. Commoditisation means banks have minimal pricing power, which ultimately results in lower returns on equity than other sectors which have better pricing power.

Risk versus reward

Assessing whether to invest in a stock, or to stay invested in a stock, is about weighing the potential reward against the potential risks. Given the tepid short- and long-term earnings outlook, the current pricing of CBA seems exorbitant both against local and global peers.

***

In my first article this week, I look at hedge fund manager, Jim Simons, who perhaps has claim to being the world's greatest ever investor. His main fund has returned a breathtaking 62% annualised over the past 33 years, and yet the man himself is little known to the public. I explore how he's achieved his track record and what the average investor can learn from him.

In my second article, I sit down for an interview with Morningstar CEO Kunal Kapoor. Kapoor talks through a broad range of topics, including why low-cost investing wins, how artificial intelligence and ESG will bring plenty of opportunities, why 'noise' is an investor's enemy, and the implications of November's US elections for markets.

James Gruber

Also in this week's edition...

The Federal Government has finally released the Aged Care Taskforce Report which contains 23 recommendations to reform home care and residential aged care. Louise Biti goes through the key findings and who'll be made to pay for the increasing cost of aged care.

For those in their 20s and 30s, it’s tempting to give superannuation the bare minimum of attention. Yet, Meg Heffron says that if you have family members in this stage, there are two quirky super benefits worth telling them about which could prove surprisingly valuable.

The world's largest car maker, Toyota, famously bet that it wasn't worth its while to go all in on electric vehicles, suggesting hybrids were a more practical way of reducing emissions. That approach is starting to pay dividends, and Platinum's Leon Rapp says it's time to cash in.

Since the rise of ETFs, there's been a focus on fees. However, VanEck's Arian Neiron thinks investors should also understand the different indices that funds are benchmarked against, as well as the ETF managers, because these too can impact investment outcomes.

Will the RBA need to cut interest rates before the US Federal Reserve? A few months ago, this looked a ridiculous proposition. With weakening economic data in Australia and correspondingly strong data in the US, Franklin Templeton's Andrew Canobi believes it's now a distinct possibility.

Two extra articles from Morningstar for the weekend. Shane Ponraj thinks an ASX healthcare stock still seems undervalued, while Shani Jayamanne looks at the high conviction picks of fund managers that are highly rated by Morningstar.

Our white paper this week is from Magellan on the structural growth tailwinds of AI and the associated risks and opportunities.

***

Weekend market update

On Friday in the US, stocks triple-witching options expiration proved too tough for the bulls, as stocks fell by 0.7% on the S&P 500 and 1.2% for the Nasdaq 100 to leave each in the red for a second straight week. Treasurys remained under pressure at the short end with the two-year yield rising another four basis points to 4.72%, while the long bond managed to edge lower to 4.43%. WTI crude stayed at US$81 a barrel, gold ticked lower at US$2,158 per ounce and the VIX settled near 14.5.

From AAP Netdesk:

The local bourse finished lower on Friday but recouped most of the heavy losses it suffered in the morning, providing optimism the uptrend isn't over.

The benchmark S&P/ASX200 index had been down by as much as 1.5% before lunchtime but turned things around on Friday afternoon to close down just 43.3 points, or 0.56%, at 7,670.3. The broader All Ordinaries dropped 47.8 points, or 0.6%, to 7,926.2. For the week the ASX200 lost 2.25%, its worst week since September.

Eight of the ASX's 11 sectors finished lower on Friday, with energy, utilities and property gaining ground.

The heavyweight mining sector was the biggest loser, closing down 1.9%. BHP fell 1.5% to $42.41, Fortescue retreated 2.3% to $23.96 and Rio Tinto declined 1.9% to $116.95.

The Big Four banks were mixed, with NAB finishing up 0.9% to $33.81 and ANZ basically flat at $28.69. Westpac declined 1.1% to $26.19 and CBA dropped 0.6% to $115.54.

In the consumer discretionary sector, Tabcorp fell 5.2% to a two-week low of 72.5c after the wagering company announced on Thursday evening that chief executive Adam Rytenskild would step down after using offensive language in the workplace.

In the energy sector, Woodside climbed 2.5% and Santos added 2.4% amid a flurry of Ukrainian attacks on Russian oil refineries.

From Shane Oliver, AMP:

- Another hot US CPI, but it was not as bad as feared and disinflation likely remains on track. Both the headline and core CPI rose 0.4%mom in February. Energy prices rose and core goods prices rose for the first time in months and measures of inflation breadth ticked up. Producer price inflation also rose a bit more than expected. But against this the rise in goods prices in the CPI was driven by used car prices where private surveys are still pointing down, owners’ equivalent rent slowed, and services inflation slowed slightly and is likely to slow further with the cooling US jobs market. The Fed is likely to remain cautious for now but looks to remain on track for a start to rate cuts in June, although there is a high risk that it could be July.

- While US inflation data was on the hot side in February, economic activity data was soft. Retail sales rose in February after weather affected weakness in January, but the rise was less than expected and January was revised even weaker indicating a weak start to the year for consumer spending. Similarly, industrial production rose only slightly in February, but January was revised to show a bigger fall. Small business optimism remained weak and manufacturing conditions in the New York region fell sharply (albeit the NY Empire survey can be very volatile). The proportion of small businesses raising selling prices is continuing to fall. Jobless claims remained low.

- The RBA is likely to use the sticky inflation experience in the US as another reason for it to remain cautious for now at its upcoming meeting on Tuesday and reiterate that a further rate hike can’t be ruled out.

- Australia’s population boom looks to be continuing. Net permanent and long-term arrivals into Australia in January suggest immigration is continuing to strengthen or at least remain around record levels. It’s likely to slow going forward as the reopening spike in student arrivals subsides and tougher visa rules kick in but so far there is not much sign of that. Ideally, to bring underlying housing demand (which is currently running around 220,000 pa) below the ability to supply homes (completions are currently around 170,000 pa) and cut into the housing shortfall, immigration should be cut back at least to 200,000 a year (from over 500,000 currently).

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website