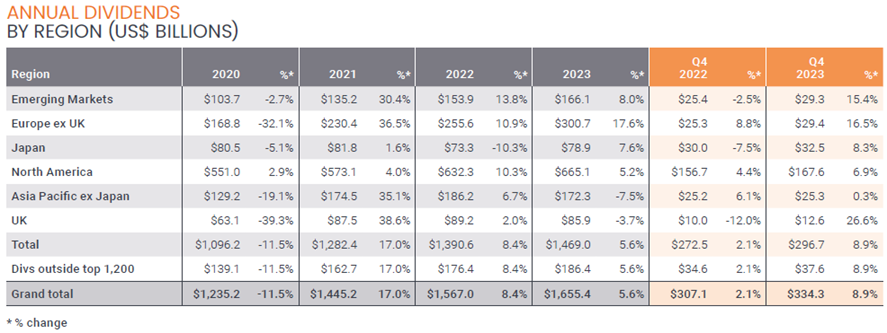

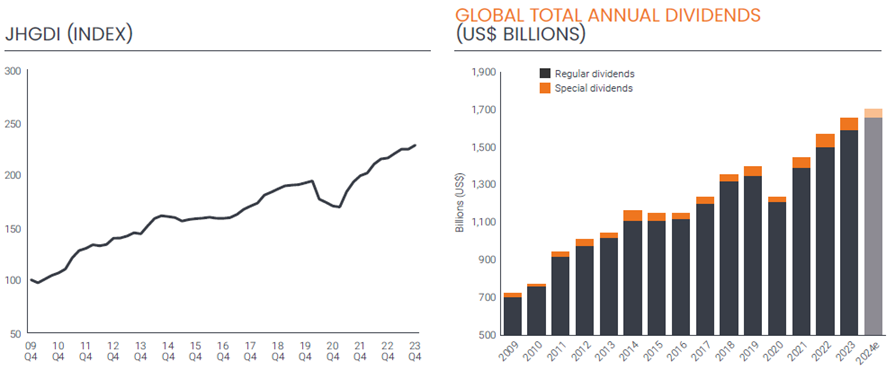

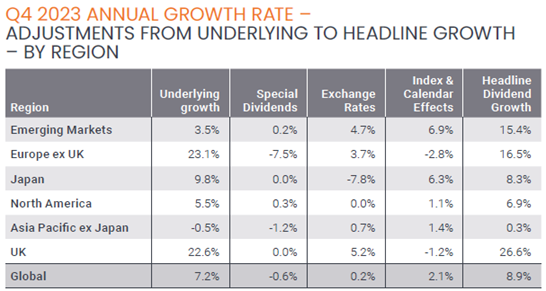

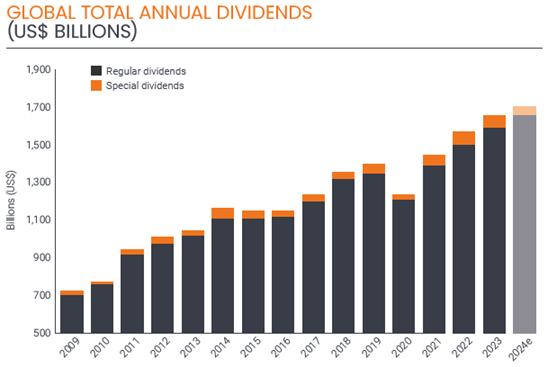

2023 saw global dividends rise to a record US$1.66 trillion, up by 5% on an underlying basis. The year ended on a particularly positive note, with Q4 dividends rising 7.2%, thanks to strength in Europe, the UK and Japan. Special dividends were larger in the fourth quarter than we had forecast and this, combined with US dollar weakness, boosted the annual headline growth rate to 5.6%, ahead of our forecast. Underlying growth was in line with our expectations for the year.1

Banks stood out

The banking sector delivered record dividends in 2023 and contributed half the world’s dividend growth, as the higher interest rate environment enabled many banks to increase their margins. In addition, lingering post-pandemic catch-up effects meant payouts were fully restored, most notably at HSBC. Emerging market banks made a particularly strong contribution to the increase, though those in China did not participate in the banking-sector’s dividend boom.

The positive impact from higher banking dividends was almost entirely offset by cuts from the mining sector, whose profits have fallen in tandem with lower commodity prices.

Beyond these two sectors, whose impact was unusually large, we saw encouraging growth from industries as varied as vehicles, utilities, software, food, and engineering, demonstrating the importance of a diversified portfolio.

Globally 86% of companies either increased dividends or held them steady but large cuts from just five companies – BHP, Petrobras, Rio Tinto, Intel and AT&T – reduced the global underlying growth rate by two percentage points.

Dividends by region

From a geographical perspective, the US, France, Germany, Italy, Canada, Mexico and Indonesia were just a handful of the 22 countries to see record payouts in 2023. Although its large size meant the US made the most significant contribution to global dividend growth, its 5.1% underlying growth rate was simply in line with the global average.

Europe ex UK was a key growth driver during the year, contributing two-fifths of the global increase. Payouts from the region rose 10.4% on an underlying basis to a record US$300.7 billion total.

Japan was also a major contributor, though the weak yen masked some of the strength shown across 91% of its companies.

Despite impressive growth among many of the banks, emerging market dividends were flat on an underlying basis, thanks to steep cuts in Brazil and lacklustre growth in China.

Meanwhile, Saudi Arabia is emerging as a significant contributor to global dividends, jumping ahead of the Netherlands in 2023 in the global rankings.

UK dividend growth of 5.4% roughly matched the global average as significant increases among the banks and oil producers were largely offset by lower mining payouts.

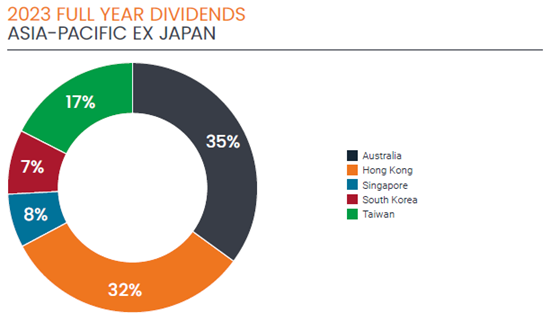

Most developed countries in Asia-Pacific ex Japan saw lower payouts year-on-year.

Pessimism over the global economy proved ill-founded in 2023 and although the outlook is uncertain, dividends look well supported – and have historically shown significantly less variability than profits. We therefore expect 2024 to show similar underlying growth to 2023, even if a likely fall in one-off special dividends reduces the headline growth rate. We therefore forecast total dividends of $1.72 trillion for 2024, up 3.9% on a headline basis, equivalent to underlying growth of 5.0%.

JHGDI (Janus Henerson Global Dividend Index)

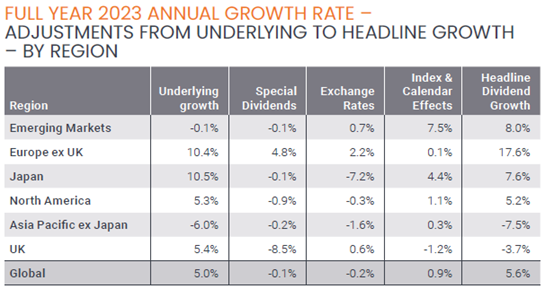

Headline v underlying

Our headline figures are simply the total amount paid by companies in our index, expressed in US dollars. We prefer to emphasise the underlying growth rates, which adjusts the headline change to take account of the impact of exchange rates, volatile one-off special dividends and technical factors related to dividend calendars and changes to our index.

In 2023, headline growth of 5.6% was very similar to the underlying 5.0% change. One-off special dividends, which are highly discretionary and rather unpredictable, were almost unchanged year-on-year and were stronger than we had anticipated for the year. Reductions in special dividends from the oil and mining sectors were offset by vehicle manufacturers (VW and Ford) and transport group Moller Maersk.

The US dollar weakened in the fourth quarter which boosted the dollar value of Q4 payments made in other currencies more than seemed likely at the beginning of the period. Over the course of the whole year, exchange rates made very little impact, reducing the headline growth rate by just 0.2 percentage points. Over the long term, the impact of exchange rates is minimal.

How Australia fared

Large cuts in the dominant mining sector during 2023 wiped out one fifth of Australia’s dividends and meant that collectively Australian payouts fell 10.7% on an underlying basis. Three quarters of companies grew their dividends or held them steady, but their increases were too small to offset the big cuts from mining groups. Double-digit growth from the banks and a one quarter increase from Woodside Energy made the most positive contributions during the year. With no mining companies represented in the fourth quarter, underlying growth of 6.9% was driven by the banks whose margins are expanding along with their peers around the world.

The outlook for dividends

Pessimism over the global economy proved ill-founded in 2023, although there was considerable divergence from one part of the world to another. Corporate cash flow in most sectors remained strong and this provided plenty of firepower for dividends and share buybacks. This resulted in 5.0% underlying global dividend growth for the full year in line with the long-term trend.

The outlook for 2024 is uncertain. The lagged effect of higher interest rates will continue to have an impact, with slower global economic growth anticipated and higher funding costs for companies. We are nevertheless optimistic for dividends in the year ahead. The run-rate of US dividend growth in the fourth quarter bodes well for the full year, Japanese companies have embarked on a process of returning more capital to shareholders, Asia looks likely to pick up, and dividends in Europe are well supported. From a sector perspective, even though the rapid growth we have seen from banks around the world is going to slow this year, the rapid declines from the mining sector are also likely to make less of an impact. Energy prices remain firm so oil dividends look well supported and the big defensive sectors like healthcare, food and basic consumer goods should continue to make steady progress. What’s more, dividends are much less variable than profits over time.

We therefore expect 2024 to deliver similar underlying growth to 2023. One-off special dividends are by their very nature unpredictable, but they are unlikely to sustain the record levels we have seen over the last three years, so we assume these will fall to levels more in line with the pre-pandemic average of around $45 billion. Meanwhile, if the US dollar sustains its current lower levels against major global currencies, then we will see a small exchange-rate boost at the headline level. We therefore forecast total dividends of $1.72 trillion for 2024, up 3.9% on a headline basis. This equates to underlying growth of 5.0%.

Ben Lofthouse is Head of Global Equity Income at Janus Henderson Investors. Unless otherwise stated all data is sourced by Janus Henderson Investors as of 31 December 2023. Nothing in this document should be construed as advice. Past performance does not predict future returns. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

1.We previously published a forecast for 5.3% for underlying growth, but after some data revisions related to the classification of special dividends in 2022, this became equivalent to 5.0%, in line with the actual outturn.