As 30 June approaches there are many things SMSF trustees must consider to maintain a complying superannuation fund as well as take advantage of tax benefits. Here’s my Top Ten.

1. Valuation

The assets in your SMSF must be valued each financial year. Your administrator needs to report the market value of the assets in the SMSF’s financial statements for income tax purposes and your auditor needs to verify that the SMSF has not contravened any provisions of the income tax and superannuation laws. The valuation must be based on objective and supportive data - refer to ATO publication: Valuation guidelines for SMSFs.

2. Contributions

Make sure current year contributions are received by your SMSF on or before 30 June. Remember that electronic funds transfers may not be credited into your SMSF’s bank account until the following business day.

If making a non-concessional contribution (NCC), check NCCs made during the last two financial years to see if the bring forward provision has been triggered. It will affect the amount you can contribute in the current financial year.

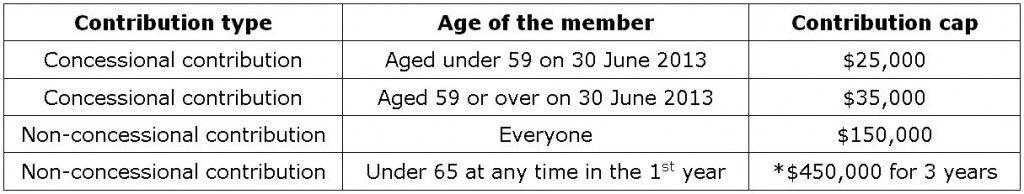

The contribution caps (CCs) for the current financial year (i.e. 1 July 2013 to 30 June 2014) are:

*Only people who are aged under 65 at any time in the first year of contribution can bring forward two years of NCCs and make three years worth of NCCs (i.e. a total of $450,000) in one year or over three years.

3. Employer contributions

Employers are required to make Superannuation Guarantee (SG) contributions by the 28th day of the month following the end of the quarter in which an employee’s salary was earned. An employee’s SG contribution for the June 2013 quarter (i.e. last financial year) may have been received by your SMSF around 28 July 2013 (i.e. current financial year). If so you will need to include the SG contribution in your CC cap for the 2013-2014 financial year.

4. Salary sacrifice contributions

If you have a salary sacrifice arrangement (SSA) with your employer to sacrifice your pre-tax wages into superannuation, these are treated as CCs. Check your records before contributing more CCs to avoid exceeding your CC cap.

5. Tax deduction on your personal superannuation contributions

A tax deduction is restricted to self-employed people and people who either do not receive any superannuation support (e.g. retirees) or receive very limited superannuation support from their employer. They must also be aged under 75. If you are eligible to claim a tax deduction then you will need to lodge a ‘Notice of intention to claim a tax deduction’ with your SMSF trustee before you lodge your personal income tax return. Your SMSF trustee must also provide you with an acknowledgement of your intention to claim the deduction. The amount claimed as a deduction will change the character of your original NCC into a CC.

6. Spouse contributions

If you are intending to make NCCs for your spouse, you will need to make sure the contributions are received by your SMSF on or before 30 June in order for you to claim a tax offset on your contributions. The maximum tax offset that you can claim is 18% of NCCs of up to $3,000 (i.e. $3,000 x 18% = $540 maximum claimable). To claim the maximum tax offset your spouse’s income must be $10,800 or less in a financial year. The tax offset progressively decreases for income over $10,800 and cuts out when income reaches $13,800 or more. Your spouse must be under 70 years of age. If your spouse is aged 65 to 69, they must be gainfully employed for at least 40 hours over 30 consecutive days. You will also both need to be Australian residents for tax purposes and not be living separately and apart on a permanent basis at the time the contribution is made.

7. Contribution splitting

CCs made into your SMSF can be split between you and your spouse. The requirement is that your spouse must not have reached their preservation age or if they have reached their preservation age, they need to be aged under 65 and not retired from the workforce. The maximum amount that can be split for a financial year is 85% of the CCs made into your SMSF in that financial year up to your CC cap. You cannot split NCCs.

If you are intending to split contributions, you must do so in the financial year immediately after the one in which your contributions were made. This means you can split CCs you have made into your SMSF during the 2012-2013 financial year in the 2013-2014 financial year. You can only split contributions you have made in the current financial year (i.e. 2013-2014) if your entire benefit is being withdrawn from your SMSF before 30 June 2014 as a rollover, transfer, lump sum benefit or a combination of these. If you split your CC with your spouse, the full amount of the original CC counts towards your CC cap. In addition, you cannot claim the superannuation spouse contribution tax offset for a contribution split to your spouse’s superannuation account.

8. Superannuation co-contribution

Under certain circumstances, the Commonwealth Government will match your NCCs with a co-contribution of up to $500 per year. To be eligible you must earn at least 10% of your income from business and/or employment, be a permanent resident of Australia, and be under 71 years of age at the end of the financial year. The government contributes 50 cents for each $1 of your NCC to a maximum of $1,000 made to your SMSF by 30 June 2014. To receive the maximum co-contribution of $500, your total income must be less than $33,516. The co-contribution progressively reduces for income over $33,516 and cuts out altogether once your income is $48,516 or more.

9. Low income superannuation contribution

If your income is less than $37,000 and either you or your employer have made CCs into your SMSF, you could be entitled to a refund of the 15% contribution tax (up to $500) paid by your SMSF on these contributions. To be eligible, at least 10% of your income must be from business and/or employment and you must not hold a temporary residence visa. To receive the refund, you need to make sure that the CCs are received by your SMSF by 30 June 2014.

10. Minimum pension payments

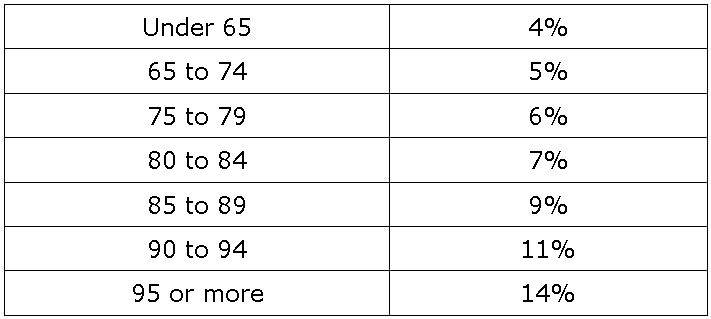

If you are accessing an account-based pension from your SMSF, make sure that the minimum amount required to be paid under the superannuation law is paid from your SMSF by 30 June 2014 in order for your SMSF to receive tax exemptions. The minimum amount is determined by your age and the percentage value of your pension account balance at either the commencement date of the pension or 1 July each year. See the table below for your percentage value.

There is no maximum pension payment amount required unless you are accessing your pension under the ‘Transition To Retirement’ (TTR). The maximum amount that you can receive from your SMSF under TTR is 10% of your pension account balance. If you exceed the maximum limit under TTR, then your SMSF will not be entitled to tax exemptions.

Monica Rule is the author of the book The Self Managed Super Handbook. Monica is running an SMSF Seminar on 3 July 2014. See www.monicarule.com.au