Discussions on sequence or series risk regularly appear in the specialist financial media, and are increasingly appearing in the general press. In simple terms, fear of sequence risk drives investors to take equity and risky asset exposures out of their retirement portfolios.

Sequence risk is the fear that a series of bad returns in the early stages of retirement drawdown will significantly diminish capital values such that the portfolio is incapable of recovery, can't support future drawdowns and will not meet its investor's longer term needs.

Analysis of Australian historical data suggests that sequence risk for retirees may not be the danger claimed. If this is true, then many of the standard approaches to investment within retirement plans are flawed. Specifically, this includes notions of decreasing growth asset exposure with age and deferring home equity release opportunities to later stages of retirement. History actually shows that there are good arguments for increasing growth asset exposure around retirement. We show that this is consistent with the data from three countries: Australia, the UK and the US.

Background

For the last 10 years, FinaMetrica has provided advisers in nine countries with 40-plus years of performance history for a wide range of portfolio asset mixes for both lump sum investments and regular savings from an investor's perspective. In the UK, the rolling 10-year real return for a 40% growth portfolio over the last 40-plus years has been 5.5% p.a, in the US 5.5% and Australia 5.9%. What would have happened if a higher growth asset exposure had been selected? Not as much as might be expected. An 80% UK growth portfolio would have delivered 0.9% p.a. more at 6.4% p.a. In the US 6.9% p.a., a 1.4% increment; and in Australia 7.1% p.a., a 1.2% p.a. increment.

Our data set is based on mainstream accumulation indexes, rebalancing each year. So on face value there has been little additional return for the greater exposure to growth assets and the associated volatility.

Australian withdrawal history shows counter-intuitive outcomes

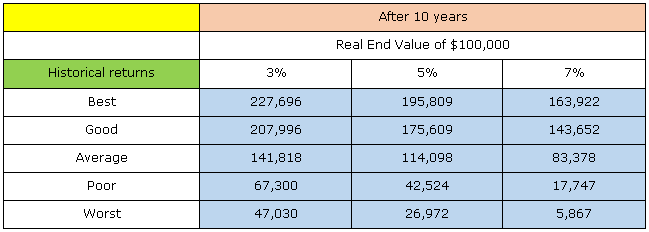

In our example for 40% growth portfolio using the returns described above, we drawdown $3,000 p.a., $5,000 p.a. and $7,000 p.a., adjusted for inflation each year from a $100,000 portfolio. There is no allowance for fees, taxes or other frictions which can amount to 200 bps (2.0%) or more each year. The real balances after ten years are shown in the main body of the table.

Table 1: Real end value of portfolio based on different drawdown rates (3%, 5% and 7%)

The Good means a result that was higher than 95% of the results and, similarly, the term Poor means a result that was higher than only 5% of the results. The Average is the average return. We can discount the Best and the Good as we shouldn't be over-emphasising high returns to investors. It's the Average, Poor and Worst outcomes that need to be explored.

The account balances alone don't provide any easy insight into the future so we looked to reinterpret the data consistent with the number of future years the real income might continue to be withdrawn at the end of the tenth year. We can divide the closing 'real' balances for future annual payments by $3,000, $5,000 and $7,000 and see the future year payments.

We now have a framework for comparing retirement benefits based on future payments.

- After 10 years our $3,000 p.a. withdrawing investor had on average 47.3 more years’ payments. In the Poor case (5%) she had 22.4 more years. And the very Worst 15.7 more years.

- After 10 years our $7,000 pa withdrawing investor had on average 12.3 more years’ payments. In the poor case (5%) she had 2.8 years. And the very Worst 0.8 more years.

How does this compare to the client who took on the additional 40% risky asset exposure and ran with an 80% Growth asset portfolio? We already know that the additional return was 1.2% p.a. in Australia over the last 40-plus years. Averages can hide all sorts of unexpected insights.

- Best, Good and Average returns are generally consistent with what most would expect. The additional growth asset exposure delivers better returns, much better than might have been expected considering the annualised incremental return was only 1.2% p.a. greater.

- The Poor and Worst returns are another matter. They are counter-intuitive. Investors didn't necessarily have a lower return for lower growth asset exposure.

- Investors were not significantly worse off for taking the 40% higher exposure to growth assets.

Comparison of Australia with the UK and US

Is this an Australian aberration? How does this compare to similarly exposed portfolios in the UK and US? (see attached paper for more detail if required).

- The patterns are similar in both the US and UK to Australia for a 40% growth portfolio across all five cases. There is no significant differences in future year payments for portfolios across countries in Poor and Worst cases.

- The patterns are similar for the 80% growth portfolio as the 40% growth asset portfolio in both US and UK.

- Specifically, there's no significant differences in future year payments for portfolios across countries in Poor and Worst cases.

- A 5% withdrawal rate leaves investors with potential additional payments after 10 years for a further 20.1 years in UK, 19.5 years in US and 26.2 years in Australia in Poor cases. The Worst cases are also consistent.

Is sequence risk an unnecessary anxiety?

So, at least historically, sequence risk looks to be an unnecessary anxiety. It seems to be a case of focusing on one particular part of the portfolio performance data rather than the full context. Reducing equity exposure hasn't changed the Poor and Worst returns in any meaningful way but will have likely impacted Average, Good and Best returns. In summary, the opportunity cost of being underexposed to growth assets was high.

So what are the take-aways?

- There may be no investment need to reduce growth asset exposures in portfolios around retirement. In fact, there may be an argument to increase it.

- The best retirement portfolio may be the one that best matches the investors' financial risk tolerance with assets. On that basis they are less likely to be carried away by stock and property market movements.

- Our collection of 800,000 risk tolerance test reports shows that there's little likelihood of material change to an individual's risk tolerance as they age. What changes is their perception of risk as markets move and other factors change.

- The role of annuities in an individual's retirement portfolio needs to be carefully considered.

- Short-term cash flow needs may be best financed by low cost borrowings, through a reverse mortgage for instance. And repaid when equity markets recover.

- When markets are in disarray investors may choose to spend less.

Retirement planning has never been so challenging.

For more detail on the calculations, including relevant tables on the results and a comparison with the UK and US, see the full research paper. This article is for general education purposes and does not address the specific circumstances of any individual investor.

Paul Resnik is a co-founder of FinaMetrica, which provides best-practice psychometric risk tolerance testing tools and investment suitability methodologies to financial advisers in 23 countries.

Peter Worcester has spent 40 years working in the financial services industry. He is an actuary, has been a director of several financial planning firms, and has been an investment manager with several firms.