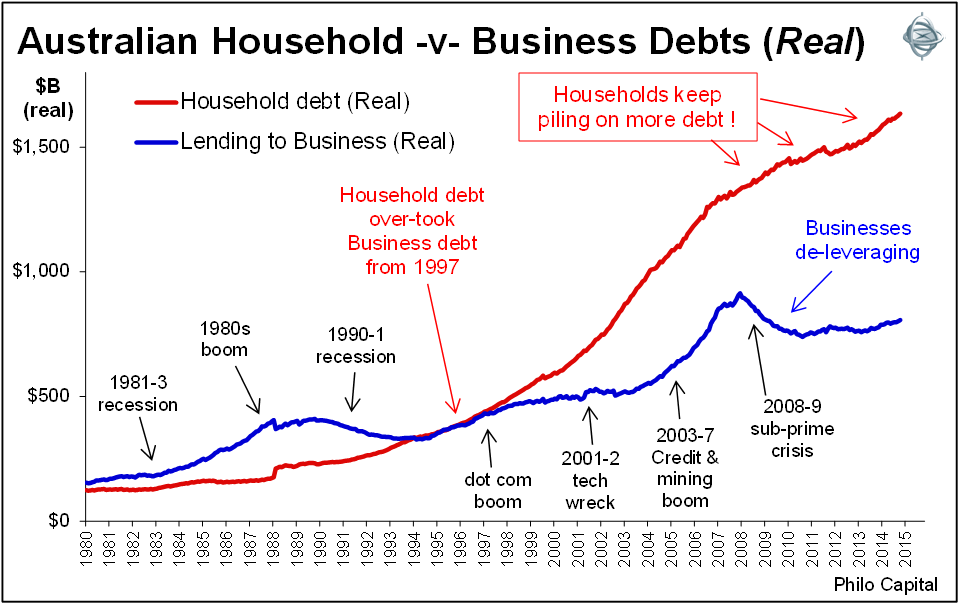

Lending patterns can often provide valuable insights into likely future trends. Two key indicators are the pace and type of lending. The first chart shows lending to businesses (blue) and to households (red) in Australia since 1980, in real terms after CPI inflation.

Pace of lending

Rapid growth in business lending almost always indicates profligate wasteful acquisitions at the tops of booms. These booms tend to be followed by economic contractions and ‘de-leveraging’ when companies collapse and banks write off bad debts.

Business lending has been in recession for the past seven years since the sub-prime crisis. Despite Australia’s population growing by 10% over the period, lending to business has contracted by 10% in real terms after inflation. Long periods of lending recession mean businesses have not been investing for future growth. Likely consequences of this include lower jobs growth, lower productivity growth, lower living standards and lower earnings per share growth in future if the trend continues.

Business lending has only recently shown early signs of life but there are usually long time delays between lending, business investment and resultant growth in productivity and earnings.

Structure of lending

In 1997 lending to households overtook lending to business for the first time in Australia’s history, aided and abetted by bank deregulation, bank capital rules that artificially favoured housing lending (because house prices never fall, do they?!) and by the rapid growth of mortgage securitisation. The level of household debt has expanded rapidly ever since and is now more than twice the level of business lending.

Why is this important? Lending to business is usually productive as most (apart from wasteful acquisitions at the height of booms) is spent on new staff, plant & equipment, technology and R&D. On the other hand lending to households is mostly unproductive. Mortgage lending mostly just pushes up the prices of existing housing, and personal lending is mainly spent on consumption, mostly supporting foreign jobs, not local.

Since the financial crisis, households have piled up debt fuelled by unsustainable record low interest rates. Weak growth in jobs and productivity are incompatible with high household debt levels and high house prices propped up by unsustainably low interest rates. Something has to give - either a housing bust or a long decline in living standards.

Broadly-based housing busts are usually caused by high interest rates and high unemployment levels but these are unlikely in the near future, so a sudden housing crash is not likely. Interest rates are very low and unlikely to rise soon and foreign demand for housing remains strong. There will however be severe declines in concentrated apartment markets that are being over-built, notably in Melbourne and Brisbane.

Long term trends

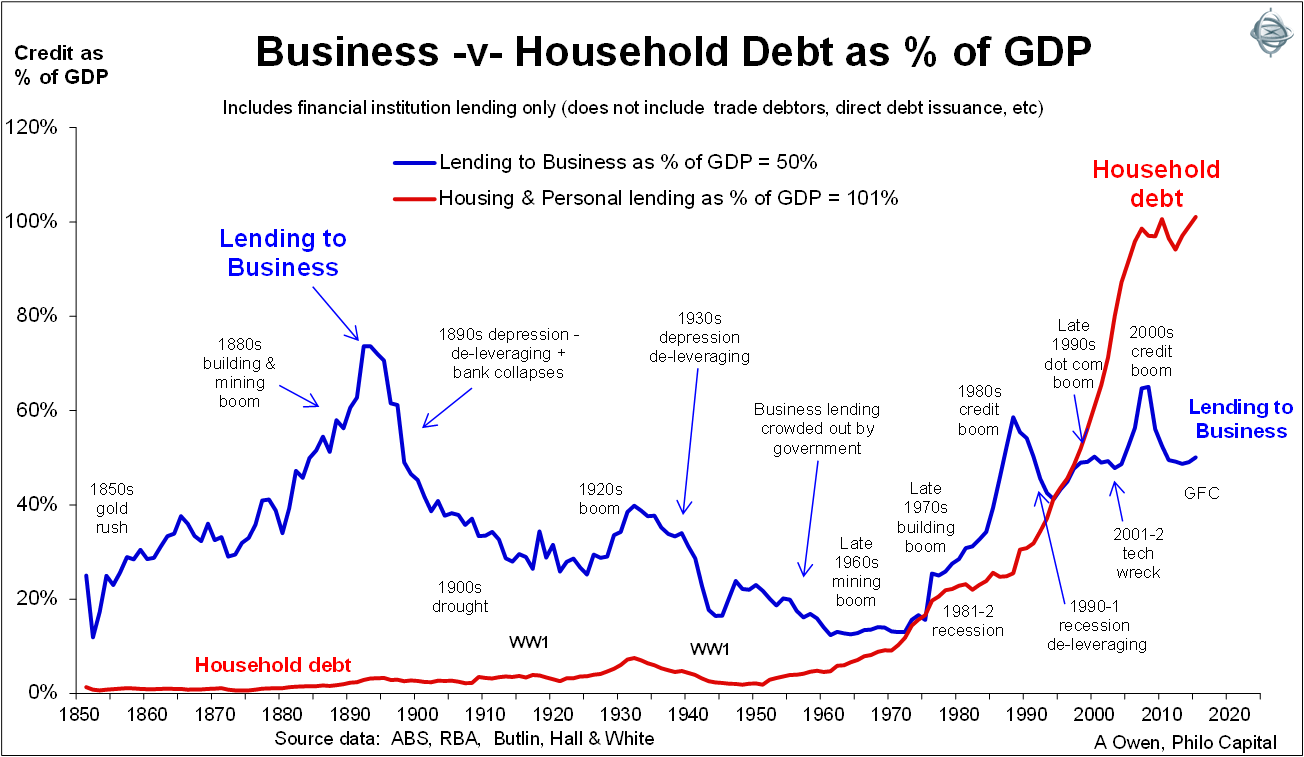

The chart below shows the levels of business lending and household lending in Australia since 1850 relative to gross national income.

Business debt levels over time

Here we see the great corporate debt build-ups in the 1880s property and mining boom, in the 1980s ‘entrepreneurial’ boom and in the 2003 to 2008 credit and mining boom. Each of these lending binges collapsed quickly and were followed by painful de-leveraging, economic contractions, and debt write-offs by the banks.

Not all booms were financed by massive surges in debt. Notably, the late 1960s speculative mining boom and the late 1990s ‘dot-com’ boom were both financed largely by equity. Most of the money came from ‘investors’ who threw money at hundreds of speculative floats of new companies. In each case almost all of these speculative floats had nothing but hype and hope and they disappeared very quickly, taking their investors’ equity capital with them.

We can see from the chart that the recent seven year period of business de-leveraging has not been inconsistent with other long periods of de-leveraging after the collapses of debt-fuelled booms. The current level of business lending is not low by historical standards.

Today banks are still writing off bad debts from financing over-priced acquisitions and unproductive projects undertaken in the recent mining boom. There is likely to be more bad debts to come, notably where LNG prices are collapsing due to global over-supply and weak demand growth, and costs are blowing out severely.

Household debt levels over time

Whereas business debt levels have remained well within the range of prior boom/bust cycles, household debt levels have exploded in recent years. After the speculative ‘entrepreneurial’ stock market boom collapsed in the 1987 crash, ‘investors’ switched their zeal to residential property, financed by cheap debt following interest rate cuts. This debt-fuelled boom soon collapsed in the deep 1990-1991 recession and Westpac and ANZ banks posted billion dollar losses and cut dividends.

The same pattern took place again over the past decade. After the 2003-2007 boom collapsed in the 2008-2009 sub-prime crisis, global credit crunch and sovereign debt crisis, the interest rate cuts starting in late 2011 have fuelled another debt-fuelled boom in residential property. This will end the same way as previous debt-fuelled booms. (There is also a serious boom underway in commercial property, but that is being financed largely by foreign equity capital, mainly from Asian funds, rather than by local bank debt).

How we compare

What level of household debt is productive or healthy for an economy? Probably it should be lower than the level of business lending, currently around 50% of GDP, which is where it is in Germany and the rest of Western Europe today.

Australia’s household debt at 101% of GDP is lower than the UK (182%) but it is significantly higher than the US (80%) and Western Europe.

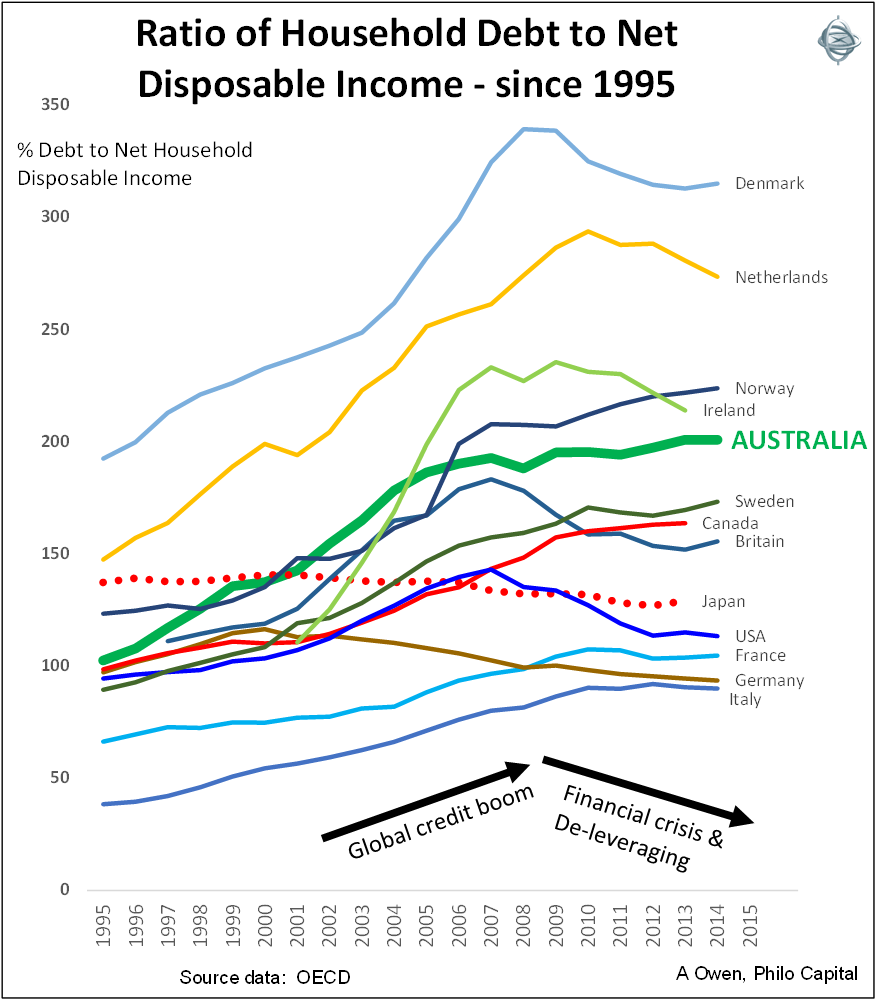

A more common measure of household debt is the ratio of household debt to the level of household net disposable income, because income is required to service the debt. The next chart shows this ratio in major countries over the past 20 years.

While households in most countries have de-leveraged since the financial crisis, households in some countries like Norway, Sweden and Australia are still gorging on cheap debt, encouraged by the ultra-loose monetary policies adopted by the world’s central banks, including zero or negative interest rates and ‘quantitative easing’ (central banks buying bonds and other assets with newly printed money) to force interest rates down further.

Scandinavian countries appear on the chart above Australia, but Australia’s household debt burden is actually higher than theirs. How? Because our interest rates are much higher.

For example, Denmark has negative official interest rates and Danish mortgage interest rates are near zero. One bank (Nordea Credit) even offers mortgages with negative interest rates – yes they pay borrowers to take out a loan!

Household debts, current account and market volatility

Because Australia has higher inflation and higher population growth, and because our banks are a cosy oligopoly that protects their margins and fees, we are unlikely to see mortgage interest rates drop to Scandinavian levels.

When adjusted for the interest rates paid on household debt, Australia’s household debt levels are the highest in the world. This, when combined with sluggish business lending and business investment, is likely to be a drag on growth in productivity and living standards in the coming years.

High household debt levels are also likely to prolong our reliance on foreign debt, to finance the mountain of mortgage debt (channelled into Australia via the banks and mortgage securitisers) and also to finance future growth. This is reflected in our persistent current account deficits. Heavy reliance on foreign debt makes us vulnerable to shocks in fickle foreign debt markets. It was this heavy reliance on foreign debt that caused the US sub-prime crisis (which had nothing to do with Australia) to rapidly and seriously infect our banking system and stock market in 2008-2009.

Australia’s ongoing obsession with housing financed by a mountain of foreign debt continues this vulnerability to the impact of external shocks to our financial markets and it exaggerates our boom and bust cycles. This creates threats but also great opportunities for vigilant investors.

Ashley Owen is Joint CEO of Philo Capital Advisers and a director and adviser to the Third Link Growth Fund. This article is for general education only, not personal financial advice.