A week rarely passes without a market commentator criticising SMSFs for holding only 0.5% of their portfolios in global shares. Shame on all those trustees. Apparently, SMSFs are not diversified enough, they have insufficient exposure to great technology and consumer companies listed overseas, there is too much home bias. A typical institutional investor holds 20% to 25% of a default investment strategy in global shares (see, for example, APRA’s Annual Superannuation Bulletin).

At the recent launch of his new global listed investment company, Geoff Wilson of Wilson Asset Management said, “About 65% of them [his investors] are SMSFs, which are grossly underweight international equities.” Well-known broker Marcus Padley told his readers, “the biggest difference is that rather amazingly, considering the fall in the Australian dollar, only 0.5% of SMSF money is invested in international shares.” And this week, high profile adviser Sam Henderson wrote in the AFR, “a quick glance at the ATO's asset allocation tables will clearly illustrate that SMSFs typically invest in Australian shares and cash and have very little exposure to bonds, international shares and property.” It’s a common assertion, but it’s based on poor data.

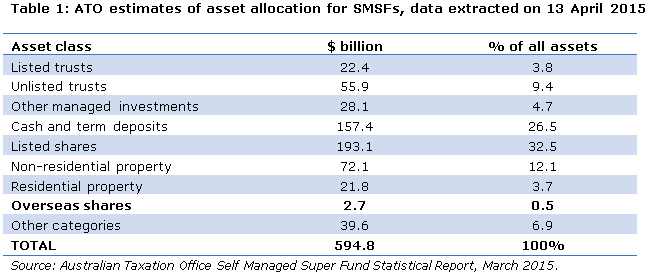

The tiny number comes from a source that the industry should be able to rely on, the Australian Taxation Office (ATO). The latest reported statistics for SMSFs for March 2015 shows ‘overseas shares’ worth only $2.7 billion, while total assets were $595 billion, as shown in Table 1. That’s 0.5%. Unfortunately, the data is misleading and counterproductive.

How does the ATO collect the SMSF data?

The ATO collects data on SMSFs via annual tax returns, but an SMSF can lodge its return up to a year or more after the end of the financial year. The ATO says its ‘estimates’ for March 2015 are extrapolated from 2012-2013 data, so the data is now two years old. Plus the ATO guesses at some allocations. For example, it advises, “Assets in trusts are treated as though half were invested in equities and half in property.” And all Australian.

There are obvious problems with old data, especially when the falling Australian dollar has increased the appeal of global equities since 2013.

However, the major problem is not the late data, but the categorisations. There is a wide range of global equity investments held by SMSFs which are categorised into listed trusts, unlisted trusts, other managed investments and even listed shares, and analysts are assuming these are all Australian equity investments.

Global equities are disguised in ATO data

It is obvious that SMSFs worth $595 billion must hold more than $2.7 billion in global equities, and even without knowing the exact numbers, global equities must make up a large proportion of many of the above categories. For example:

1. Managed investments or trusts

Consider the popularity of just two global equity managers, Platinum (funds under management $29 billion, mainly Australian retail) and Magellan (funds under management $37 billion, of which Australian retail is $10 billion). Both these fund managers attract significant support from SMSF trustees. The global funds of Schroders, Lazard, Fidelity, Vanguard, BT, Colonial First State, AMP Capital, Henderson, Aberdeen, Ibbotson and dozens of other popular managers have large SMSF support, not only in broad markets but sectors like infrastructure and resources.

2. Listed Investment Companies

Again, many popular LICs are global, such as Hunter Hall, Perpetual, Templeton, Platinum, AMP Capital China, Global Masters and Magellan. The new global fund from Wilson is targeting $550 million and Wilson says 65% of his clients are SMSFs.

3. Exchange Traded Funds

ETFs are increasingly popular with SMSFs as they are easy to transact on the ASX, and match the desire of many trustees to reduce costs. In May 2015, there were 129 ETFs trading on the ASX with a market capitalisation of $18.6 billion. Flows into global equities are among the top few categories. In 2014, net inflows into developed market global equities ranked first at $1.4 billion.

According to the BetaShares/Investment Trends October 2014 ETF Report, the third most common reason for investors using ETFs (after ‘diversification’ and ‘low cost’) was ‘to access overseas markets’, and an estimated 63,000 SMSFs held ETFs at that date.

What’s a more accurate number?

There is potential for ‘sample bias’ using any other source, because SMSF administration is highly fragmented among the 550,000 SMSFs. The best place to look is among the SMSF administrators which can delve ‘real time’ directly into the portfolios of the funds they administer.

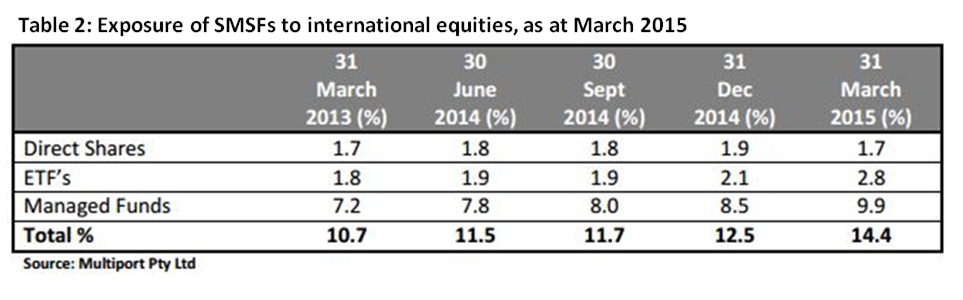

Multiport releases a quarterly analysis of SMSF Investment Patterns, based on the 2,500 funds it administers. They assigned 14.4% of SMSF assets to ‘international shares’ for March 2015, a significant increase on the 10.7% from a year earlier. This is predominantly managed funds, plus ETFs and direct shares, as shown in Table 2.

In fact, Multiport believes the global exposure may be higher, because it does not include the global equity allocation in multi sector balanced funds. On the other hand, Multiport has a large proportion of ‘advised’ SMSFs, and advisers are inclined to use managed funds. A study of the Top 10 investments by dollars shows Magellan sixth and Platinum eighth, above Wesfarmers and Woolworths.

However, another leading administrator, SuperIQ, estimates that across its 11,000 funds, only about 5% is invested in global equities, although it rises with fund size to about 9% for larger funds.

In another survey, AMP Capital’s ‘Blue Sky Report’ on SMSF opportunities, among the SMSFs which invest in managed funds, 36% say they invest in actively-managed international equities and 19% in index international equities. In July 2014, a Vanguard/Investment Trends report stated that the intention to invest in international shares by SMSFs almost doubled in the year to April 2014 from 12% to 22%.

Global equities in SMSFs much higher

SMSFs do hold more Australian shares and cash than balanced institutional portfolios, but the weaknesses in the ATO data mean there is no definitive source on the exact proportions. SMSF allocation to global shares is likely to at least 10 to 20 times the level in the ATO data. Maybe more.

In fact, the official statistics are measuring in the wrong area, because few SMSFs actually invest in global shares directly. SMSF trustees are eager to use managed funds, LICs and ETFs to gain exposure to global companies because they are far less familiar with transacting on foreign exchanges than they are on the ASX.

Given the importance of SMSFs in holding one-third of all superannuation and the retirement savings of over one million Australians, and the design of superannuation policy, the knowledge about what they invest in needs significant improvement. This applies to much of the official data produced on SMSFs.

The ATO needs to run up a few red flags about using the data. SMSFs are not as badly diversified as most claim.

Graham Hand is Editor of Cuffelinks.